Named after America’s luxury automobile, a 40 percent “Cadillac Tax” coverage. After several delays, it is currently scheduled to take effect on Jan. 1, 2022. Although the tax is still several years away and regulations may evolve before it is implemented, employers can begin to determine how their plans may be affected if the tax goes into effect. Below are common questions and answers about the tax and its potential effect on businesses.

Named after America’s luxury automobile, a 40 percent “Cadillac Tax” coverage. After several delays, it is currently scheduled to take effect on Jan. 1, 2022. Although the tax is still several years away and regulations may evolve before it is implemented, employers can begin to determine how their plans may be affected if the tax goes into effect. Below are common questions and answers about the tax and its potential effect on businesses.

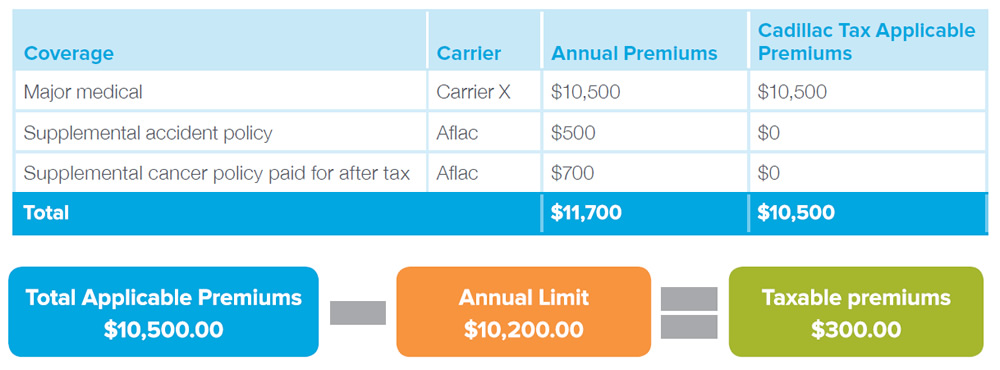

A:The tax is calculated based on premiums spent on “applicable employer-sponsored coverage.” The dollar thresholds in 2018 would have been $10,200 for individual coverage and $27,500 for family coverage. These dollar amounts are indexed so that if the tax does go into effect in 2022, and is not repealed or further delayed, the dollar thresholds will be higher as adjusted for inflation. The amount of the tax is 40 percent of the excess of the value of coverage over the dollar thresholds.

A: The tax will apply to pretax group employer-sponsored coverage, including employer- and employee-paid portions. This includes:

A: The following insurance products will not be factored into the tax:

A: Aflac’s supplemental insurance policies are defined as excepted benefits, which are excluded from most of the Affordable Care Act (ACA)’s market reforms. In the case of the Cadillac Tax, most of Aflac policies would be entirely excluded from the tax. Two types of coverage (specified disease, such as cancer coverage, and hospital indemnity) would be excluded only if the policies are paid for with after-tax dollars. These two policies would be, however, included in the tax if paid for by the employer or with pre-tax dollars, such as through a cafeteria plan or with excludable employer contributions.

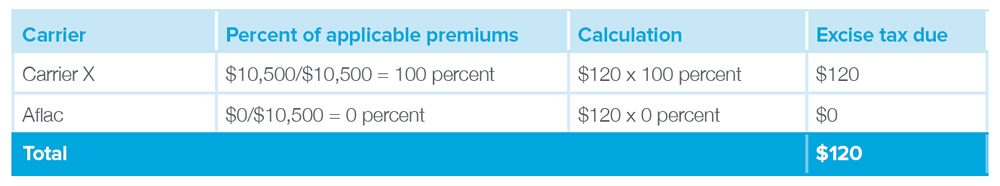

A: The tax would technically be paid by the insurance provider or carrier. If there is more than one carrier, each carrier would pay the percentage of the excise tax commensurate with their percentage of the total premiums. And if a group is self-insured, then they would be responsible for their portion of the tax based on the self-insured premiums.

The details surrounding how the tax would be reported and paid are awaiting clarification and final regulations, but since the tax would be based on their employees’ total benefits packages, employers are currently responsible for calculating the tax and reporting each benefits administrator’s portion of the tax to the IRS. Employers, not benefits providers, may be penalized for incorrectly calculating the tax.

A: Since the tax is still several years away, there’s a real possibility that the scope, application and timeframe may change. For now, it’s estimated that approximately 16 percent of all plans could be affected by the excise tax if it takes effect. The tax thresholds are linked to inflation, and medical spending and premiums historically grow faster than inflation, so eventually more plans will likely be affected. As the law stands, 75 percent of plans could be influenced by the tax within a decade.1

A: Employers do not need to make changes to their policies in anticipation of the tax just yet. Employers can begin to assess their current health plans and talk to their benefits providers or brokers about solutions to manage health plan costs.

Employee A has the following benefits package that is individual coverage, paid for on a pretax basis. In this example, the accident insurance policy would be excluded from the applicable premiums, and the cancer/specified-disease insurance policy is excluded because it is being paid for on an after-tax basis.

The excise tax will be 40 percent of $300, or $120. Each carrier’s responsibility for the tax is as follows:

This article is for informational purposes only and is not intended to be a solicitation.

Aflac coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, Aflac coverage is underwritten by American Family Life Assurance Company of New York.

1 “About That Cadillac Tax,” Health Affairs Blog, April 25, 2016. https://www.healthaffairs.org/do/10.1377/hblog20160425.054627/full/.

This material is intended to provide general information about an evolving topic and does not constitute legal, tax or accounting advice regarding any specific situation. Aflac cannot anticipate all the facts that a particular employer or individual will have to consider in their benefits decision-making process. We strongly encourage readers to discuss their HCR situations with their advisors to determine the actions they need to take or to visit healthcare.gov (which may also be contacted at 1-800-318-2596) for additional information.

Z190015

EXP 3/20