Term life insurance is a popular choice for policyholders who need temporary coverage with reasonable premiums. At Aflac, our term life insurance plans for individuals are competitive and reliable. Try our life insurance calculator to see how rates are impacted by age, lifestyle, medical history, and coverage goals.

Table of Contents

Term life insurance is a temporary policy that provides coverage for a set period, such as 10, 20, or 30 years. Below are some of the main features of a term life insurance policy:

The right term life insurance plan for you can vary based on your coverage needs and budget. There are a variety of plans to choose from, including:

Aflac offers term life insurance for individuals that you can purchase directly from Aflac. If you’re interested in term life insurance for individuals, get a quote to see which plan matches your needs and budget best.

Don’t wait until it’s too late. Help cover yourself and your family with coverage from Aflac.

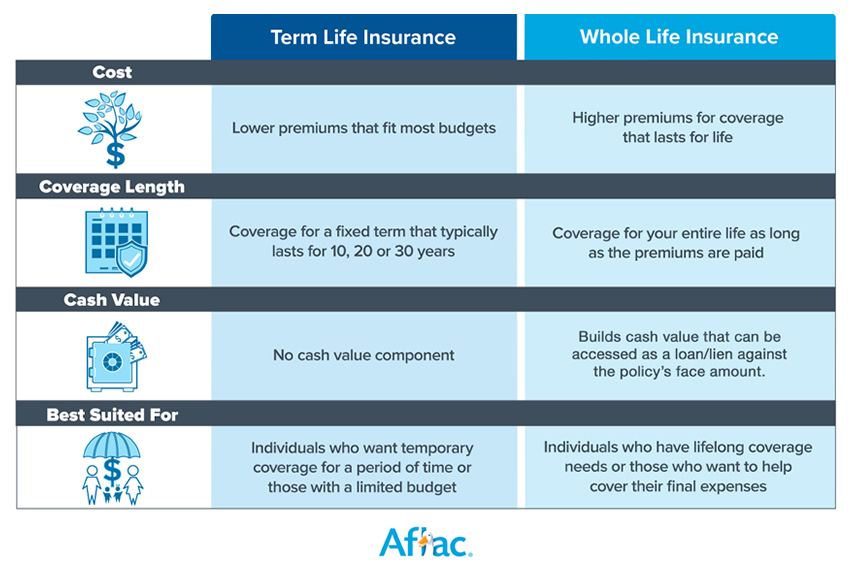

Get StartedOne of the biggest choices you may face when getting a life insurance policy is deciding between term vs. whole life insurance. They have some key differences, suiting them to different policyholders:

Aflac term life insurance may save you money upfront and provide your family with ample security. Here are a few key advantages our term life insurance plans for individuals offer:

At Aflac, we prioritize your life insurance needs. Our term life insurance coverage for individuals is portable, fits most budgets, and fast. Term life insurance is a popular choice for those who have a specific timeline they want to plan around. To see if term life insurance is the right choice for you, talk to an Aflac agent about your options.

Get Started

Wondering what life insurance policy is best for you? Find out which type of life insurance can offer you the best coverage.

The rates you'll pay for term life insurance depend on your age and other factors. Find out how rates vary with age and how to find the best term life insurance plan for you.

Content within this article is provided for general informational purposes and is not provided as tax, legal, health, or financial advice for any person or for any specific situation. Employers, employees, and other individuals should contact their own advisers about their situations. For complete details, including availability and costs of Aflac insurance, please contact your local Aflac agent.

Aflac coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, Aflac coverage is underwritten by American Family Life Assurance Company of New York.

Aflac life plans – A68000 series: In Arkansas, Idaho, Oklahoma, Oregon, Texas, Pennsylvania & Virginia, Policies: ICC1368200, ICC1368300, ICC1368400. In Delaware, Policies A68200, A68300 & A68400. In New York, Policies NY68200, NY68300 and NY68400. B60000 series: In Arkansas, Oklahoma & Virginia, Policies: ICC18B60200, ICC18B60300, & ICC18B60400. Q60000 series, Term life: In Arkansas, Idaho, Oklahoma, Oregon & Texas, Policy ICC18Q60200M. In Delaware, Policy Q60200M.Not available in Virginia.

Coverage/plan levels may not be available in all states, including but not limited to NJ, NM, NY, VA or VT. Benefits/premium rates may vary based on plan selected. Optional riders may be available at an additional cost. Policies and riders may also contain a waiting period. Refer to the exact policy and rider forms for benefit details, definitions, limitations and exclusions.

Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999

Aflac New York | 22 Corporate Woods Boulevard, Suite 2 | Albany, NY 12211

Z2200993R3

EXP 1/27