By Carolyn Smith and John Hickman, Alston & Bird, LLP

This year is already bringing quite a few developments for small employers, including welcome regulations and legislative changes. And since the year isn’t quite done, we’re likely to see even more changes before the year is through. This article highlights key changes so far relating to health plans, retirement plans and federal taxes, as well as a look to what still lies ahead.

HEALTH

The president’s executive order on health

President Trump issued an executive order in October 2017 directing federal agencies to modify regulations to increase competition and choice in health care and lower health care costs. The order listed three specific areas for reform:

Repeal of the ACA individual mandate

Starting Jan. 1, 2019, individuals who do not have qualifying health coverage will no longer face a tax penalty. The penalty remains in effect for 2018.

“Cadillac plan” tax delay

The so-called “Cadillac plan” tax is a 40 percent excise tax on the cost of employer-sponsored health coverage that exceeds specified dollar thresholds. The tax was originally scheduled to go into effect in 2018 but has been delayed several times. Under legislation enacted in January 2018, the tax is currently postponed until 2022. The tax is still under consideration by Congress. While nothing more has happened yet, it’s possible a further delay will be part of post-election lame-duck legislation.

Health savings account (HSA) update

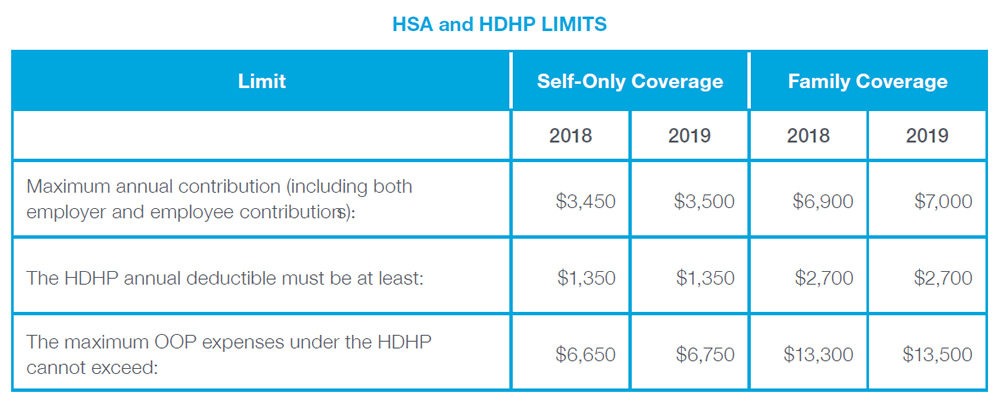

HSAs provide a tax-favored means for individuals to save and pay for medical expenses not covered by insurance. HSAs are one type of defined contribution approach to employment-based health coverage. In order to contribute to an HSA, an individual must be enrolled in a high-deductible health plan (HDHP), and no other health plan other than certain limited types of coverage (e.g., accident or disability). HSA contribution and HDHP limits are updated by the IRS each year based on inflation.

Individuals age 55 and older who are not enrolled in Medicare may make an additional $1,000 contribution each year. This catch-up contribution amount is not indexed for inflation. Legislative proposals that would enhance HSAs and make them easier to use have recently passed the U.S. House of Representatives, but the Senate has not yet acted. Proposals under consideration include allowing certain chronic care expenses to be paid from an HSA before the deductible is met, simplifying catch-up contributions for spouses who both have HDHP coverage and increasing contribution limits.

RETIREMENT

On Aug. 31, 2018, the president issued an executive order aimed at strengthening retirement security in America. The order addresses three specific areas for regulatory action.

Congress is also looking at a variety of retirement-related legislative changes this year, including provisions targeted at some of the same issues as the executive order. Both the House and Senate are working on proposals, and it’s possible that some helpful provisions may be included in 2018 year-end legislation.

TAXES

The Tax Cuts and Jobs Act (TCJA) contains the most sweeping changes to federal tax laws in decades. Enacted at the tail end of 2017, most of the provisions are first effective starting in 2018. In many respects, the law lives up to its name by significantly reducing tax rates for businesses and individuals. However, in order to help pay for reduced rates and other tax relief, the law also cuts back on and repeals some prior tax credits and deductions. The end result will differ based on the particular circumstances.

WHAT’S NEXT?

Before the end of 2018, we are expecting to see additional regulations based on the president’s executive orders on health and retirement. Congress will be back for a lame-duck session following elections, creating the possibility of additional legislative changes this year, including a possible further delay of the Cadillac plan tax and retirement legislation that will benefit small businesses.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and individuals should consult their own tax or legal advisers. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

Z181217

EXP 9/19