A quick guide to understanding the nuances between health plan options

By Carolyn Smith and John Hickman, Alston & Bird, LLP

In choosing a health plan, it is important to understand not only what the monthly premium will be, but what is (and is not) covered by the plan.

Recent federal regulations related to short-term limited duration health insurance (STLDI or “short-term” plans) have expanded the types of health coverage options available in today’s market. Having choices helps employers and individuals tailor coverage to their particular needs. Making the right choice, however, can be complicated, because coverage differs widely between various types of plans. It’s important to understand not only what the monthly premium will be, but also what the insurance plan does – and does not – cover. This article provides a brief guide to help employers and employees navigate some common health plan options.

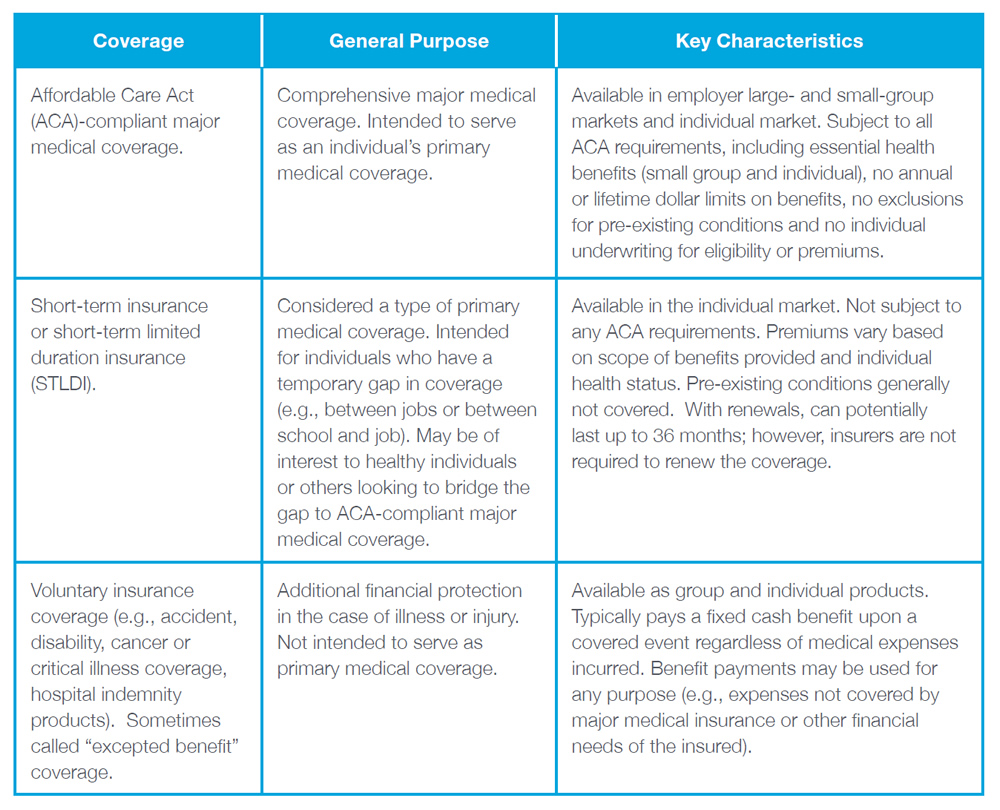

Some common coverage options – at a glance

Affordable Care Act (ACA)-compliant major medical coverage

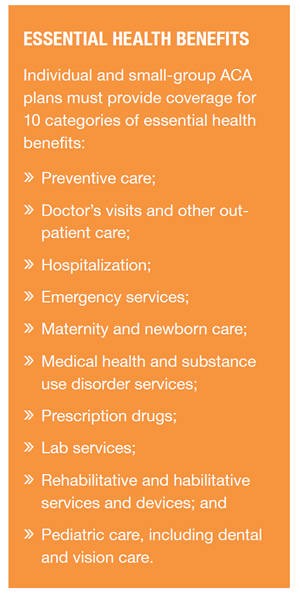

Plans subject to the Affordable Care Act provide comprehensive major medical coverage. These plans are intended to serve as an individual’s primary medical coverage and are required to meet a variety of federal standards designed to help ensure both access to coverage and the quality of coverage. ACA-compliant insurance products are available in the individual, small-group and large-group markets. Lower-income individuals who purchase individual ACA coverage through a federal or state marketplace (exchange) may be eligible for a premium tax credit to help pay the premium for the coverage.

Plans subject to the Affordable Care Act provide comprehensive major medical coverage. These plans are intended to serve as an individual’s primary medical coverage and are required to meet a variety of federal standards designed to help ensure both access to coverage and the quality of coverage. ACA-compliant insurance products are available in the individual, small-group and large-group markets. Lower-income individuals who purchase individual ACA coverage through a federal or state marketplace (exchange) may be eligible for a premium tax credit to help pay the premium for the coverage.

ACA plans:

Until Jan. 1, 2019, individuals who do not have ACA-compliant health coverage may have to pay a federal tax penalty.

Short-Term, Limited Duration Insurance (STLDI)

Short-term insurance plans are individual market products. As the name suggests, STLDI plans are designed for individuals who are transitioning from one type of primary medical coverage to another and have a temporary gap in coverage. Due to the short-term nature of these plans, they are not subject to ACA requirements. Historically, short-term coverage has generally been limited to a total coverage period of less than 12 months. New federal regulations issued in August 2018, however, allow short-term plans to continue for a total coverage period (including any renewals) of 36 months.

STLDI is generally considered a type of major medical coverage, because individuals who have such coverage typically rely on it as their primary health insurance. However, since short-term plans are not subject to ACA requirements, this coverage is very different from ACA-compliant coverage and individuals considering short-term coverage should be aware of their difference.

Short-term coverage can be useful in some situations (e.g., for individuals who are looking for coverage just until the next ACA open enrollment period). Because short-term coverage is less comprehensive than ACA-compliant coverage, it can also be much cheaper, particularly for healthy individuals.

Key differences between ACA-compliant coverage and short-term coverage:

Short-term coverage is not the same as COBRA continuation coverage which may be available when an employee or covered family member loses employer group health coverage (e.g., upon termination of employment or divorce). COBRA coverage is ACA-compliant major medical coverage.

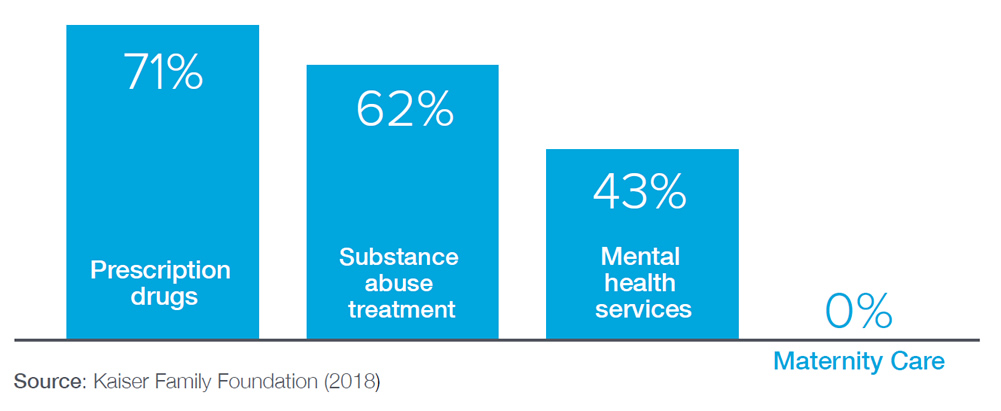

Percent of short-term plans covering select benefits

The analysis examines 24 distinct short-term insurance products currently marketed in 45 states and the District of Columbia through eHealth or Agile Health Insurance.

The federal expansion of short-term coverage to 36 months (including renewals) has been welcomed by some but has also created controversy and concern about the potential impact on covered individuals and the individual insurance market as a whole. States may impose additional restrictions on short-term coverage (e.g., restricting the coverage period or imposing benefit mandates). Thus, the scope of short-term coverage may vary state by state and the full impact of the new rules on the market may not be clear for some time.

Supplemental coverage (e.g., accident, cancer, hospital indemnity)

Supplemental insurance policies are designed to provide an additional layer of financial protection in the case of an accident or illness. These types of policies are different from ACA-compliant plans and STLDIs because they aren’t intended to serve as primary major medical coverage or a substitute for such coverage. For this reason, federal and state law have long recognized these plans as “excepted benefits.” They are generally “excepted” from requirements that apply to major medical coverage, including the ACA requirements.

These types of policies include:

Unlike typical primary medical policies, they generally pay a cash benefit triggered by covered accident or illness unrelated to the amount of expenses incurred. This cash benefit can be used for any purpose as determined by the policyholder, whether to pay for the out-of-pocket costs that add up even with major medical insurance or for other financial needs.

Which is best for me?

Whether budget is the top concern or quality is most important, it is helpful to have options for health coverage. It is also important to understand each of the options and how they fit together to provide you with the best overall benefits package. Research plans before you buy and consult with a benefits expert to help determine the benefits package that is right for you.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees and other individuals should consult their own tax or legal advisers about their situation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

1 Kasier Family Foundation (2018). Most short-term health plans don’t cover drug treatment or prescription drugs, and none cover maternity care. Accessed on Sept. 10, 2018, from https://www.kff.org/health-reform/press-release/analysis-most-short-term-health-plans-dont-cover-drug-treatment-or-prescription-drugs-and-none-cover-maternity-care/.

Z181062

EXP 9/19