By: Carolyn Smith and John Hickman, Alston & Bird LLP

OF INTEREST TO EMPLOYERS OF ALL SIZES

Health savings accounts (HSAs) provide a tax-favored means for individuals to save and pay for medical expenses not covered by insurance. In order to contribute to an HSA, the individual must be enrolled in a specially defined type of plan called a high-deductible health plan (HDHP) and have no other health plan coverage (other than certain limited types of permitted coverage such as vision, dental, accident, specified disease and certain fixed indemnity coverage). The combination of an HDHP and an HSA is commonly referred to as a consumer-driven health plan. While the premium for the HDHP may be only slightly lower than the premiums for health plans with a lower deductible, the tax savings from the HSA is what generally makes these arrangements attractive. HSAs were first available starting in 2004. Since then, as traditional health coverage premiums have continued to increase, interest in these types of consumer-driven health plans has increased. Survey data indicates that in 2017, 43.7 percent of persons under age 65 with private health insurance were enrolled in an HDHP, including 18.2 percent who were enrolled in an HDHP with an HSA.1 Legislative and regulatory changes have recently been proposed (but not yet adopted) that would make HSAs even more accessible and easier to use.

This article provides an overview of HSAs. Future articles will address key compliance issues and any applicable regulatory or legislative developments in greater detail, if they occur.

1. WHAT IS AN HSA?

An HSA is a tax-favored account that is established through a bank or other qualified financial institution. Often, insurance companies that offer high-deductible health plans that are compatible with HSAs partner with financial institutions that administer HSAs. Similar to an individual retirement arrangement (IRA), HSAs are owned by the individual account holder. This means that, unlike health flexible spending arrangements, any unspent funds remain in the account and accumulate from year to year, with earnings based on how the HSA is invested. Because the HSA is owned by the individual, they are also portable – that is, they remain the property of the individual even if they change employers (or retire). Also similar to an IRA, the HSA may be transferred to a beneficiary upon death.

2. HOW ARE HSAS TAXED? THE TRIPLE TAX TRIFECTA

Contributions made to an HSA by eligible individuals are deductible for federal (and most state) income tax purposes (regardless of whether the individual itemizes deductions). Employer contributions (including pretax salary reductions) are excludable from employees’ incomes and are not subject to payroll (e.g., FICA) taxes.

Income on amounts held in an HSA accumulates on a tax-free basis until withdrawn from the account.

Distributions from an HSA for qualified medical expenses are tax-free. In order to qualify, these expenses must not be reimbursed from another source and must be incurred after the HSA is established. Non-qualifying distributions are includible in income and also subject to an additional 20 percent tax. The additional 20 percent tax does not apply to distributions made after the individual account owner reaches age 65, becomes disabled or dies. Thus, if not needed for medical expenses, HSAs may be used to supplement retirement income.

3. WHO CAN ESTABLISH AN HSA?

In order to contribute to an HSA, the individual must be covered by an HDHP and no other health plan, other than certain limited types of coverage. Individuals who are enrolled in Medicare are not entitled to contribute to an HSA.

4. WHAT IS AN HDHP?

An HDHP is a health plan that does not pay any benefits (other than for certain preventive care) before the deductible is met. The individual is responsible for 100 percent of covered medical expenses (other than permitted preventive care) before reaching the plan’s deductible.

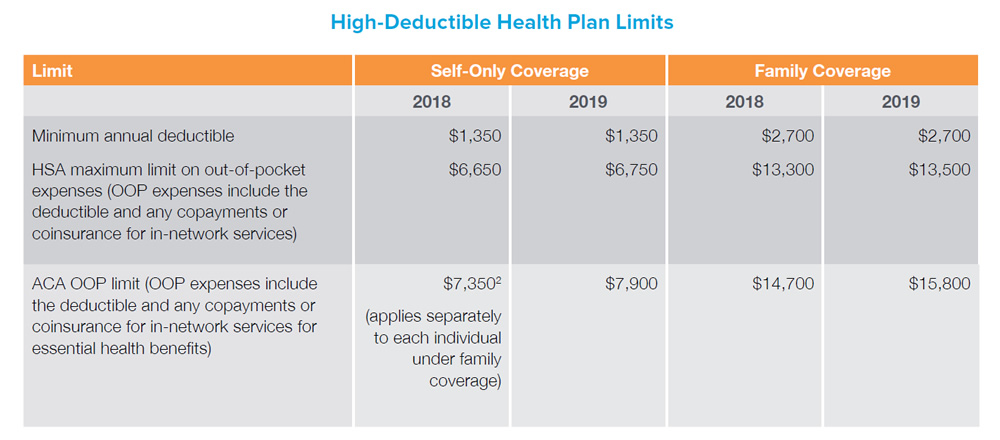

An HDHP must also satisfy dollar limits on the deductible and out-of-pocket (OOP) medical expenses, as summarized in the following table. These dollar limits are indexed annually. Applying the OOP limit looks a little complicated, because there are two different limits that apply: one under the definition of an HDHP for HSA purposes and the other under the Affordable Care Act (ACA) that applies generally to medical plans. As a general rule, the HDHP need merely comply with whichever limit is the most restrictive.

5. WHAT TYPES OF COVERAGE IN ADDITION TO THE HDHP ARE PERMITTED?

HDHPs are intended to make individuals more aware of and involved in their health care decisions by ensuring that the individual has “skin in the game” for medical expenses before the deductible is met. Thus, in general, individuals may not have health coverage in addition to an HDHP and also qualify for an HSA. The HSA helps to fill the gap by providing a tax-favored means of saving for medical expenses not covered by the HDHP.

A limited exception applies, however, for certain types of permitted insurance and permitted coverage. Under this exception, individuals can have certain types of coverage and still be eligible to contribute to an HSA. Permitted insurance and coverage includes:

6. What are the HSA contribution rules?

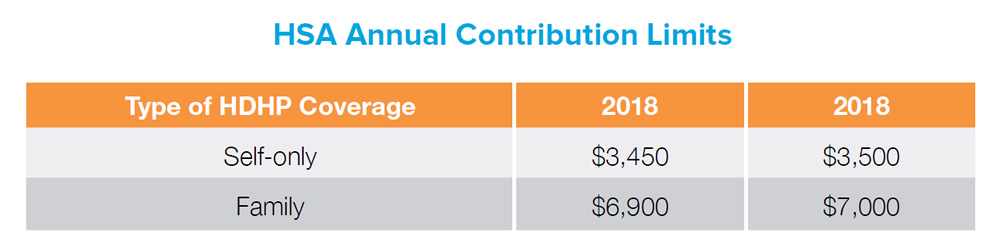

The maximum permitted HSA contribution varies based on whether the coverage is self-only or family coverage and is subject to adjustment for inflation.

Individuals age 55 and older and not enrolled in Medicare may make an additional $1,000 contribution each year. This amount is not indexed for inflation. Spouses who are both eligible to contribute to an HSA cannot make this additional contribution to the same account. Each spouse needs to have their own account in order for both spouses 55 or older to make the additional $1,000 contribution.

Both employers and employees may contribute to an HSA. Total combined contributions cannot exceed the maximum contribution limit.

Employer contributions may be subject to nondiscrimination rules that require the employer to make “comparable contributions” for comparable participating employees in the HDHP.

In practice, these comparable contribution requirements seldom apply, as there is an exception for any employer that allows employees to make salary reduction contributions through a cafeteria plan.

7. What medical expenses can be paid tax-free from an HSA?

In general, qualifying medical expenses for HSA purposes are out of pocket medical expenses incurred after the HSA is established. For HSA purposes, medical expenses are defined in the same way that medical expenses are defined under the federal tax laws for purposes of the itemized deduction for medical expenses (without regard to the adjusted gross income limitation on deductible medical expenses).3 Under this definition, medical expenses include the cost of diagnosis, cure, mitigation, treatment or prevention of disease, and the cost for treatments affecting any part or function of the body. Thus, for example, qualified medical expenses include amounts paid to medical care providers before the deductible under the HDHP is met and for any copayments or coinsurance after the deductible is met. Qualified medical expenses also include medical expenses that are not covered by the HDHP, such as vision or dental benefits (if not covered). There is no complete list of qualifying medical expenses; however, the IRS has provided a listing of common expenses in IRS Publication 502.

Individuals can receive tax-free distributions for qualifying medical expenses, even if they are no longer eligible to contribute to an HSA. Qualifying medical expenses also include expenses incurred by the HSA owner’s spouse and dependents.

There are also some important limitations on medical expenses that can be paid tax-free from an HSA:

8. Are HSAs subject to ERISA?

Whether an HSA is subject to the Employee Retirement Income Security Act of 1974 (ERISA) depends on the level of involvement of the employer. The Department of Labor (DOL) has issued guidance that employers may follow so that their HSAs are not subject to ERISA. Most employers structure their HSA program in accordance with the DOL guidance in order to avoid triggering ERISA application to the HSA. Note that a group HDHP offered by the employer is likely to be a group health plan subject to ERISA even though the corresponding HSA may not be.

Under DOL guidance, an HSA will generally not be subject to ERISA if the following six requirements are satisfied:

An HDHP coupled with an HSA program may be an attractive choice for many employers and employees. Surveys indicate that such arrangements are becoming more popular as HDHP coverage becomes more predominant. For those employers offering an HDHP, supplemental indemnity coverage (such as accident, specified disease and hospital indemnity coverage) provides an attractive offering to supplement any such coverage arrangement. Stay tuned for future articles, as we provide an update of new HSA developments.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees should consult their own tax or legal advisors. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

1 https://www.cdc.gov/nchs/data/nhis/earlyrelease/insur201805.pdf .

2 Note that an embedded individual OOP limit applies for ACA compliance purposes, but no such requirement applies for HSA purposes.

3 The adjusted gross limit is 7.5 percent in 2018 and increases to 10 percent in 2019.

Z180707

EXP 6/19