By Carolyn Smith and John Hickman, Alston & Bird, LLP

Quite a few health and other employee benefits policy changes developed in 2018. The full list includes some welcome regulations and legislative changes, but also new restrictions on some popular taxfavored benefits. This advisory highlights key policy changes as well as upcoming deadlines in the year ahead.

NEW EMPLOYEE BENEFIT LEGISLATION

The Tax Cuts and Jobs Act (TCJA) contained the most sweeping changes to federal tax laws in decades. Read the Advisory.

Enacted at the tail end of 2017, most of the provisions were first effective starting in 2018. In many respects, the law lives up to its name by significantly reducing tax rates for businesses and individuals. However, in order to help pay for reduced rates and other tax relief, the law also cut back on and repeals some prior tax credits and deductions. Key changes made by the TCJA with respect to employee benefits included the following:

In addition to these changes, TCJA included a variety of other provisions that reduced tax benefits for certain common arrangements, including changes to the tax rules for meals and entertainment and significant changes to the deductibility of certain executive compensation.

The Bipartisan Budget Act relaxed rules for hardship distributions from 401(k) plans.

The main purpose of the Bipartisan Budget Act (BBA), enacted in February 2018, was to provide funding for the federal government. A few employee benefit plan changes went along for the ride, including the relaxation of rules related to hardship distributions from 401(k) plans and similar arrangements. Under the BBA, qualified nonelective contributions (QNECs), qualified matching contributions (QMACs), and earnings on QNECs, QMACs and 401(k) elective contributions may be distributed on account of hardship. A participant is not required to take out a loan before taking a hardship distribution. Both these changes applied to plan years beginning after Dec. 31, 2018. The BBA also directed the IRS to revise regulations relating to hardship distributions to eliminate the requirement under the IRS safe harbor that a participant cannot make 401(k) contributions for six months following a hardship distribution. In November, the IRS published proposed regulations making that change, as well as a variety of other changes to the hardship distribution rules.

NEW EMPLOYEE BENEFIT REGULATIONS

The president’s executive order on health: Two final rules and one proposed rule were issued in 2018 in response to the president’s October 2017 executive order on promoting health care choice and competition. Read the Advisory.

EEOC wellness plan rules: In 2017, the EEOC issued comprehensive rules governing wellness program compliance under the Americans with Disabilities Act (ADA) and the Genetic Information Nondiscrimination Act (GINA). These rules added a number of new compliance obligations and established somewhat of a safe harbor (30 percent) for the value of wellness program incentives. In AARP v. EEOC, the incentive safe harbor portion of these rules has been set aside. For 2019, employers with wellness programs that include incentives should review the impact of this decision on their programs.

On the retirement side: The Department of Labor took the first formal step in fulfilling the directives of the president’s August 2018 executive order on retirement plans and issued proposed rules on multiple employer plans (MEPs). Similar to the goals of the AHP rules, the proposed MEP rules would clarify the circumstances under which an employer group or association or a professional employer organization (PEO) could sponsor a workplace retirement plan. The rules are expected to be finalized in early 2019.

The president also directed the DOL and IRS to make retirement plan notices more understandable and useful for plan participants, while also reducing the costs on employers. Finally, the IRS was directed to review the life expectancy and distribution tables currently used for determining required distributions from tax-qualified plans. The objective was to bring the tables up to date so that retirement funds can be drawn out more slowly, rather than forcing larger distributions earlier on. So, stay tuned, as there will be more to come on retirement plans.

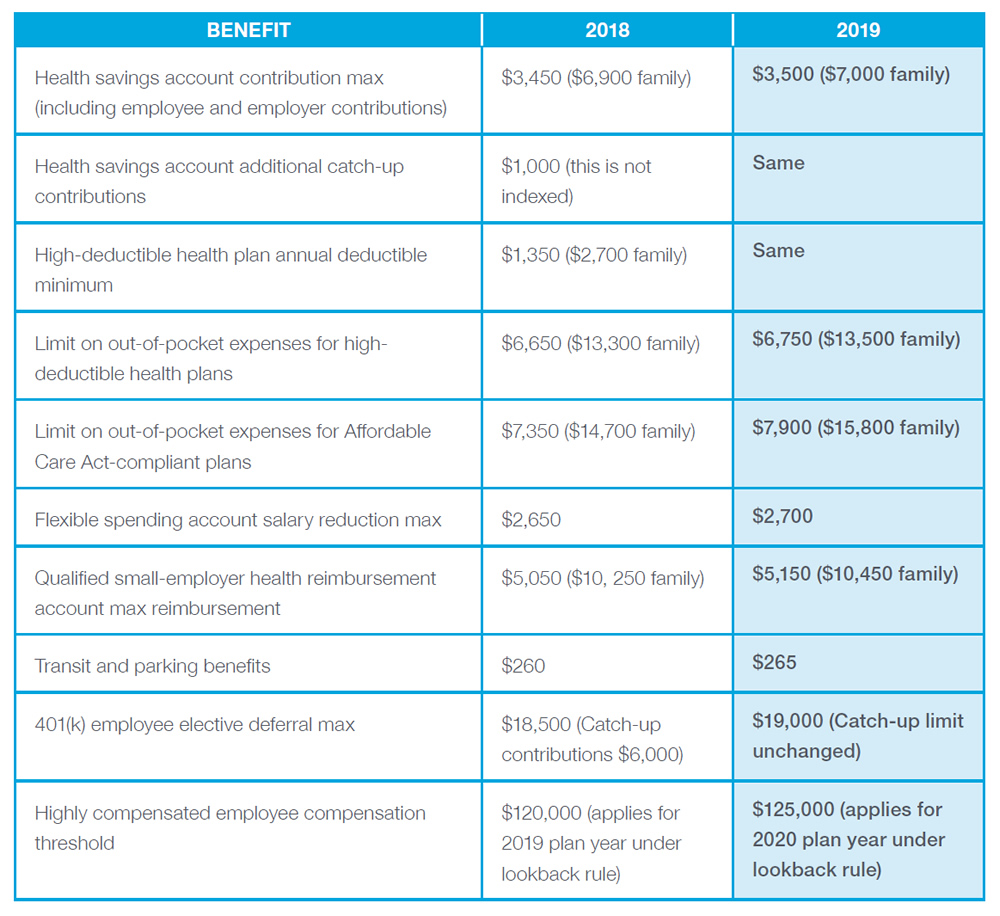

2019 COST-OF-LIVING ADJUSTMENTS FOR POPULAR BENEFITS

WHAT TO EXPECT NEXT: UPCOMING DEADLINES AND EFFECTIVE DATES

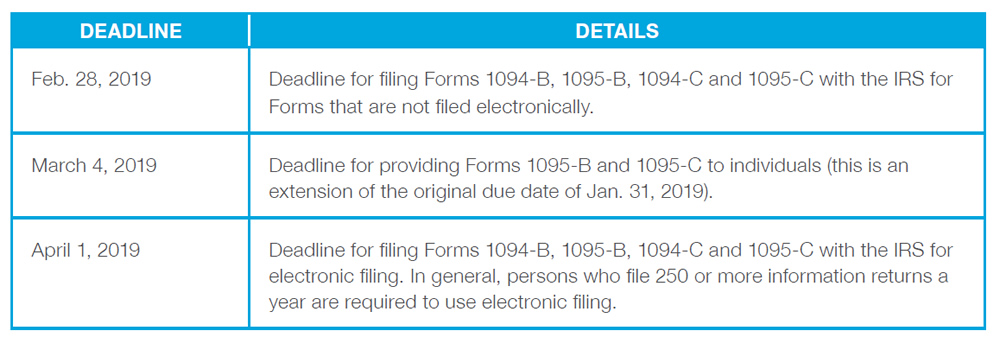

Health Coverage Reporting Deadlines for 2018 Minimum Essential Health Coverage (MEC)

The Affordable Care Act (ACA) requires employers, insurers and certain other providers of minimum essential coverage (MEC) to provide health coverage information to individuals and the IRS. Here’s a reminder of what’s required:

The IRS recently announced the deadlines for providing the 2018 forms, including an extended due date for furnishing the forms to individuals. There is no extension of the time for filing with the IRS. The IRS also provided some penalty relief for good faith compliance. The filing deadlines are below. For more information see IRS Notice 2018-94.

PCORI Fee:

The Patient-Centered Outcomes Research Institute (PCORI) fee was imposed under the ACA for plan years ending on or after Oct. 1, 2012, and before Oct. 1, 2019. These dates follow the fiscal year of the federal government, which ends on Sept. 30 of each calendar year. The fee is paid once each year and is due on the July 31 following the end of the plan year. For example, for a calendar-year plan, the fee for 2018 is due on July 31, 2019.

The fee was imposed on specified health insurance and is payable by the employer or other plan sponsor of a self-funded plan and by the insurer with respect to fully insured coverage. The fee is based on the average number of lives covered under the plan. Special rules apply for health reimbursement arrangements (HRAs) required to report.

For plan years ending on or after Oct. 1, 2018, and before Oct. 1, 2019 (e.g., in the case of the 2018 plan year for calendar-year plans), the fee is $2.45 per participant. More information can be found on the IRS PCORI Fee website.

“Cadillac Plan” tax delay: The so-called “Cadillac Plan” tax is a 40 percent excise tax on the cost of employer sponsored health coverage that exceeds specified dollar thresholds. The tax was originally scheduled to go into effect in 2018 but has been delayed several times, most recently by legislation enacted in January 2018. The tax is scheduled to go into effect in 2022, unless it is further delayed by Congress.

Is there more to come?

Late in 2018, a federal district court judge in Texas ruled that the repeal of the Affordable Care Act’s individual mandate makes the entire law unconstitutional. The ruling is not a final order and doesn’t stop the enforcement or need to comply with the ACA. However, the ruling will be appealed and, ultimately, the case may end up in the Supreme Court. If so, it would be the third time the Court has addressed the ACA. Policy will continue to evolve, and we’ll likely see more changes in the new year.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and individuals should consult their own tax or legal advisers. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

WWHQ | 1932 Wynnton Road | Columbus, GA 31999.