By: Carolyn Smith, John Hickman and Scott Harty, Alston & Bird LLP

Congress finished up 2017 with a bang by passing the Tax Cuts and Jobs Act. The bill was signed into law by President Trump on Dec. 22, 2017. The TCJA lives up to its name in many ways, including by slashing the corporate income tax rate, reducing the tax rate for business income of “pass-through businesses,” such as partnerships, S corporations, and independent contractors, and reducing individual income tax rates. However, in order to help pay for reduced rates and other tax-relief provisions, the TCJA also eliminates or cuts back on many individual and business tax deductions and credits. As the saying goes, the devil is in the details, and the ultimate impact on a particular business or individual will vary based on the specific circumstances. Most of the provisions of the TCJA became effective Jan. 1, 2018, meaning that the new law is in effect even though some of its provisions are not yet fully understood and very little guidance has been issued by the IRS.

Delays of a number of tax provisions related to health care, including a two-year delay of the Cadillac tax, were included in a separate legislation addressing funding for the federal government signed into law Jan. 22, 2018.

This advisory provides a high-level overview of certain aspects of these recent tax law changes. This advisory is of interest to employers of all sizes.

The individual mandate, which imposes a tax penalty on individuals who do not have minimum essential coverage, is repealed effective Jan. 1, 2019. The mandate remains in effect for years before 2019, including 2018. The Cadillac tax is delayed for an additional two years and (unless further delayed or repealed) will take effect in 2022. The tax on health insurance companies (often called the “health insurance tax,” or HIT) for major medical coverage is suspended for 2019. Although insurance companies are legally liable for this tax, it is generally passed on to employers and other policyholders as part of the premium. The suspension of the medical device tax is continued for 2018 and 2019.

Other taxes and fees related to health care remain in effect, including the employer penalty provisions that apply to applicable large employers (that is, employers with at least 50 full-time equivalent employees for the prior year) if affordable minimum-value coverage is not provided. There is also no change in the Affordable Care Act employer health coverage reporting requirements.

The Tax Cuts and Jobs Act cuts business tax rates and makes other business-friendly changes to the tax laws. Key provisions include the following:

For pass-through businesses, the TCJA provides tax relief through a new, and complicated, deduction for 20 percent of certain qualified business income. Pass-through businesses include partnerships, limited liability companies (LLCs), S corporations and sole proprietorships (e.g., an individual performing services as an independent contractor). Whereas the income of C corporations is taxed twice, once at the corporate level and again when dividends are distributed to shareholders, the income of pass-through businesses is taxed only at the individual level (i.e., all the income is “passed through” to the individual owners of the business). Tax relief for pass-through businesses could have been provided through further reductions in individual income tax rates. However, a variety of concerns and issues led to the adoption of another method designed to separate “business income” from “personal service income.”

In addition to being complicated, the new deduction is also subject to a variety of limitations. Here’s a high-level outline:

These limitations represent a compromise of differing goals. On the one hand, Congress wanted to provide tax relief for all types of businesses, not just corporations. On the other hand, Congress also wanted to prevent potential avoidance of individual tax rates through the recharacterization of personal service income as “business income.”

The TCJA also cuts back on or repeals a number of current business deductions and credits to pay for tax rate cuts, including the following:

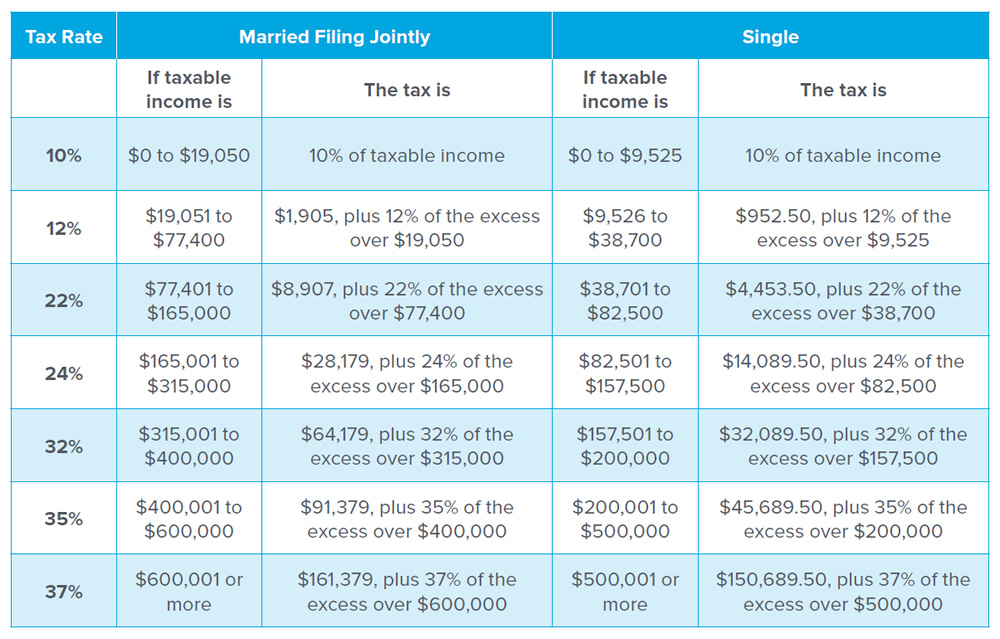

The TCJA generally lowers individual income tax rates. However, because the way in which taxable income is calculated is also changed (e.g., through modifications to deductions), not all individuals will necessarily see their taxes reduced.

Different rate brackets apply to other situations not listed above, such as individuals filing as heads of household and married taxpayers filing separately.

The tax rates on capital gains and qualified dividends are not changed. Thus, the maximum rate of tax on such income is generally 20 percent or 15 percent, with higher rates for certain assets. The 3.8 percent net investment tax, enacted as part of health care reform, remains in effect. This tax applies to married taxpayers filing joint returns with modified adjusted gross income in excess of $250,000 ($125,000 for single taxpayers).

The TCJA combines individual personal exemptions and the standard deduction into a new, higher standard deduction. For 2018, the standard deduction is $12,000 for single filers and $24,000 for married taxpayers filing joint returns.

By way of comparison, under prior law, in 2018, a married couple with two children would have been eligible for a standard deduction of $13,000 and personal exemptions of $16,600, for a combined deduction of $29,600 (compared to the lower new standard deduction of $24,000 under the TCJA). Thus, the loss of personal exemptions may result in a lower deduction under the TCJA compared to prior law. However, there are other provisions in the TCJA that may alleviate this impact, and the overall result may still be a lowering of taxes, depending on the particular circumstances. For example, the repeal of the personal exemption phase-out (PEP), enhancements to the child tax credit (including a doubling of the credit from $1,000 per child to $2,000 per child) and changes to various itemized deductions could impact taxes under the TCJA compared to prior law.

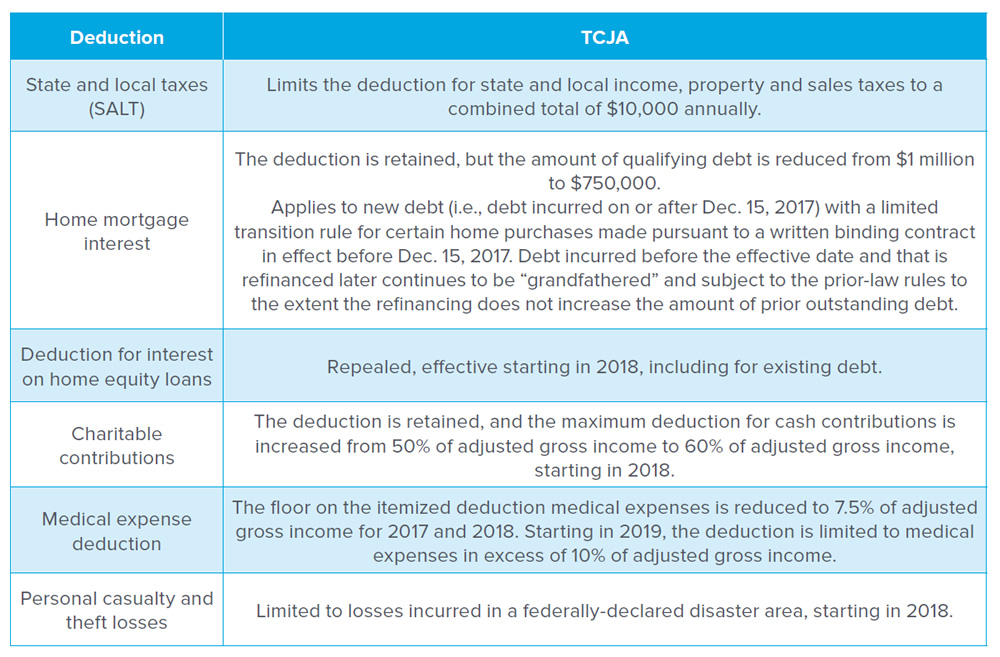

As a result of the increased standard deduction and new limitations on itemized deductions, fewer people are expected to itemize deductions starting in 2018. The following chart provides a high-level overview of how the TCJA has changed some popular itemized deductions.

The TCJA increases the AMT exemption amounts and the thresholds at which the exemption amounts begin to phase out. In 2018, for married taxpayers filing joint returns, the exemption amount is increased to $109,400 and the phase-out threshold is increased to $1 million. For single taxpayers, the exemption amount is increased to $70,300 and the phase-out threshold is increased to $500,000. These dollar amounts are indexed for inflation.

The changes to the individual income tax provisions generally are temporary, and will revert back to prior law after 2025 (unless Congress acts before then to extend or modify the law).

An early version of what became the TCJA had proposed eventual repeal of the estate tax. The final version keeps the tax in place, but reduces the impact by doubling the exemption amount from $5 million to $10 million. The $10 million will be indexed for inflation. The provision is effective for estates of persons dying and gifts made after Dec. 31, 2017. The new provision sunsets so that the estate tax provisions revert back to prior law after 2025 (unless extended or modified before then).

The TCJA promises significant tax relief and will deliver on that promise for many businesses and individuals. However, the 185-page law contains many details that will have a different effect on each situation, which can’t be addressed in a short overview. Businesses and individuals should consult their tax advisors to determine exactly how they will be impacted by the new law.

This Advisory is provided for general informational purposes only and is not provided by Aflac or Alston & Bird LLP as tax or legal advice for any person or for any specific situation. Businesses and individuals should consult their own tax advisors regarding their situations.

Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.