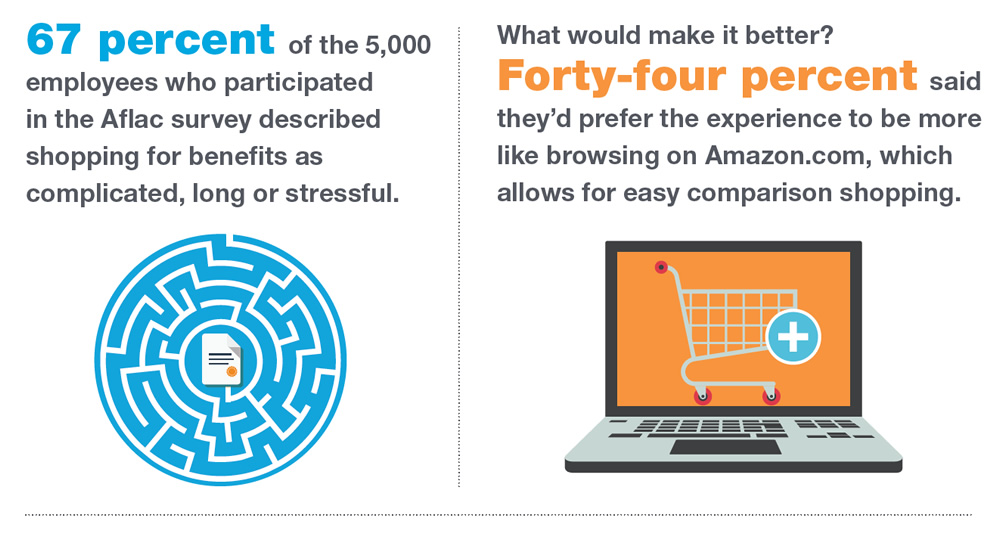

What does benefits open enrollment have in common with Amazon, the online retailer? Not enough, according to today’s employees.

The results of the 2017 Aflac WorkForces Report* reveal that American workers are fans of the Amazon experience and would like to see the retailer’s convenient shopping model applied to the benefits selection process.

As the open enrollment season approaches, you can use the results of the Aflac WorkForces Report to make the benefits selection process easier and more convenient for your company’s employees. By understanding what bothers workers most about open enrollment, you can team with your agent or broker to build better enrollment processes and communications.

With that in mind, here are five key employee disconnects and desires:

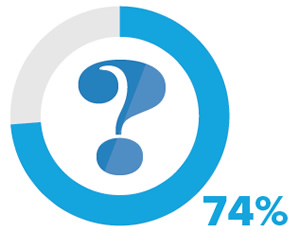

Lack of comprehension. From deductibles to copayments to providers, employees are in the dark: 74 percent say there are at least some things they don’t understand about their policies.

Lack of comprehension. From deductibles to copayments to providers, employees are in the dark: 74 percent say there are at least some things they don’t understand about their policies.

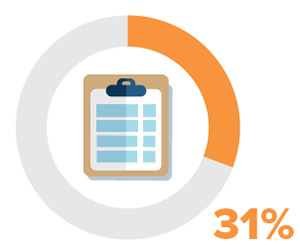

Not enough information. What do employees want? Thirty-one percent say what they need most before their next open enrollment is more information about things like out-of-pocket costs and which doctors are in their networks.

Not enough information. What do employees want? Thirty-one percent say what they need most before their next open enrollment is more information about things like out-of-pocket costs and which doctors are in their networks.

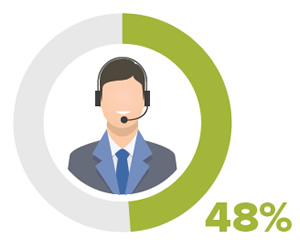

Professional advice. While employees don’t spend time researching benefits on their own, they’re not averse to meeting with a professional who’s done the legwork for them: 48 percent of employees say they would prefer to speak to an expert about their benefits, either in person or on the phone.

Professional advice. While employees don’t spend time researching benefits on their own, they’re not averse to meeting with a professional who’s done the legwork for them: 48 percent of employees say they would prefer to speak to an expert about their benefits, either in person or on the phone.

Just as employees want benefits experts to do the research for them, Aflac has done the research for you through its annual WorkForces Report. The results can be used to put together a simpler, more effective open enrollment plan that helps give employees what they want in the way they want it.

Open enrollment season is quickly approaching, so now is the time to meet with your benefits advisor about the best, most efficient ways to communicate with employees about their choices. It’s also the time to work with your agent or broker to make sure your company’s current voluntary benefits options are comprehensive and in line with today’s employee needs – and to ensure your benefits roster is not outpaced by that of your competitors.

This article is for informational purposes only and is not intended as a solicitation.

Coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, coverage is underwritten by American Family Life Assurance Company of New York.

*The 2017 Aflac WorkForces Report is the seventh annual study examining benefits trends and attitudes. The study’s surveys, conducted by Lightspeed GMI, captured responses from 1,800 benefits decision-makers and 5,000 employees across the United States in various industries. For more information, visit AflacWorkForcesReport.com.

Z170992

EXP 8/18