Not too far in the past, Americans could pretty much rely on obtaining good and relatively inexpensive insurance through an employer’s major medical insurance plan. How times have changed. Today, some employees don’t have access to insurance through work at all, while a growing number rely on HDHPs – high-deductible health plans – which are increasingly popular among companies trying to control costs.

Exactly what is an HDHP? Put simply, it’s a health insurance option that trades high premiums for higher deductibles. In other words, these plans, which are sometimes referred to as consumer-driven health plans, require employees to pay lower monthly premiums but higher deductibles and out-of-pocket medical expenses.

That sounds great – and it can be, if the employee and any insured family members remain healthy. But it can become problematic in the event of unexpected medical bills, especially when you consider that 65 percent of employees would be able to pay less than $1,000 for out-of-pocket expenses if they experienced an unexpected serious illness or accident today.1

That sounds great – and it can be, if the employee and any insured family members remain healthy. But it can become problematic in the event of unexpected medical bills, especially when you consider that 65 percent of employees would be able to pay less than $1,000 for out-of-pocket expenses if they experienced an unexpected serious illness or accident today.1

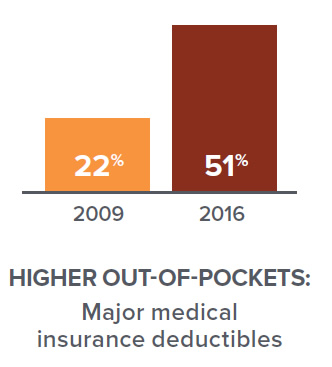

Still, HDHPs apparently are here to stay. According to the 2017 Aflac WorkForces Report, they’re the only option for 61 percent of today’s workforce.1 And even employees who aren’t technically enrolled in HDHPs cannot escape higher out-of-pocket costs. According to the Kaiser Family Foundation, just 22 percent of covered workers had major medical insurance deductibles of $1,000 or more in 2009. By 2016, that number had jumped to more than half, or 51 percent.2

Still, HDHPs apparently are here to stay. According to the 2017 Aflac WorkForces Report, they’re the only option for 61 percent of today’s workforce.1 And even employees who aren’t technically enrolled in HDHPs cannot escape higher out-of-pocket costs. According to the Kaiser Family Foundation, just 22 percent of covered workers had major medical insurance deductibles of $1,000 or more in 2009. By 2016, that number had jumped to more than half, or 51 percent.2

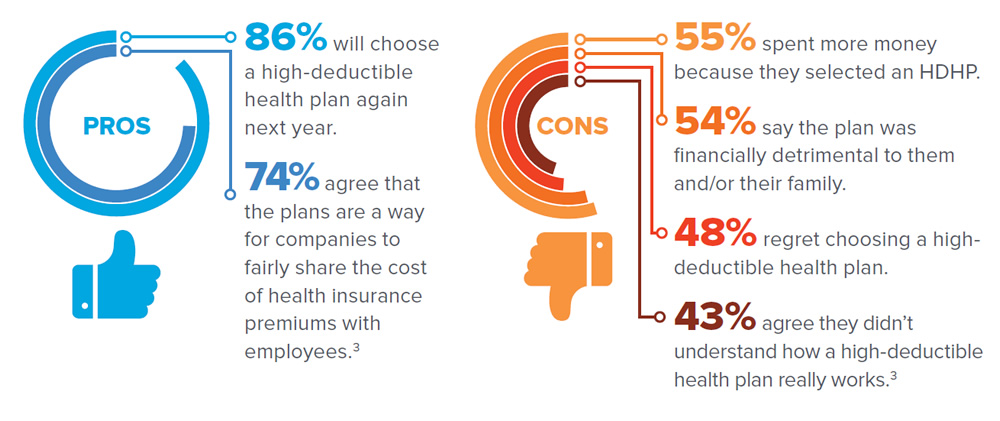

The Aflac WorkForces Report revealed that employees have somewhat of a love-hate relationship with HDHPs, something that employers should consider as open enrollment comes around. Here’s what workers had to say, both the pros and the cons:

Given such mixed reviews – as well as the precarious state of employee bank accounts – one thing employers can do to sweeten their benefits options is add voluntary health insurance choices. Voluntary insurance works hand in hand with major medical plans to help ensure individuals who are sick or hurt have the funds needed to pay health-related costs their primary insurance doesn’t cover. After all, when a medical event occurs, there are deductibles, copayments and treatment costs to consider – not to mention the everyday bills that continue to roll in even if an individual is too ill or injured to work.

As an employer, there are many reasons to consider making voluntary insurance available to workers – and to clearly communicate its value:

Voluntary insurance pays cash benefits workers can use to help pay unexpected health care costs that might not be covered by major medical insurance or to help pay bills that threaten their financial security.

Voluntary insurance pays cash benefits workers can use to help pay unexpected health care costs that might not be covered by major medical insurance or to help pay bills that threaten their financial security.With deductibles and copayments skyrocketing – both for employees enrolled in HDHPs and those who are not – just one hospital stay can wreak havoc on an employee’s finances. It’s a simple fact, but it’s one that underscores the importance of voluntary insurance and the financial protection it helps provide.

This article is for informational purposes only and is not intended as a solicitation.

Coverage is underwritten by American Family Life Assurance Company of Columbus. In New York, coverage is underwritten by American Family Life Assurance Company of New York.

1 The 2017 Aflac WorkForces Report is the seventh annual study examining benefits trends and attitudes. The study’s surveys, conducted by Lightspeed GMI, captured responses from 1,800 benefits decision-makers and 5,000 employees across the United States in various industries. For more information, visit AflacWorkForcesReport.com.

2 The Henry J. Kaiser Foundation. “2016 employer health benefits summary.” Accessed July 24, 2017. http://www.kff.org/report-section/ehbs-2016-summary-of-findings.

3 Somewhat, strongly or completely agree.

Z171001

EXP 8/18