The eighth annual Aflac study offers a fresh look at trends and solutions to enhance benefits options and delivery in the evolving public sector workplace.

5 key benefits solutions for the public sector

1. Tailor benefits to meet business objectives.

One of the most important objectives concerning public sector employers is managing productivity, which means finding the right talent and keeping them engaged is an important investment. Tailoring benefits to employees’ needs is one way to help. When employees are confident in their benefits packages, it can help them stay engaged for the long haul.

Managing productivity and finding qualified talent are top concerns for public sector employers. Of the following business objectives, which is the most important for your company right now?

2. Measure and track benefits usage and satisfaction.

Public sector employers say their employee benefits programs strongly influence:1

Popular measures include:

3. Offer customizable benefits to help meet employees’ individual needs.

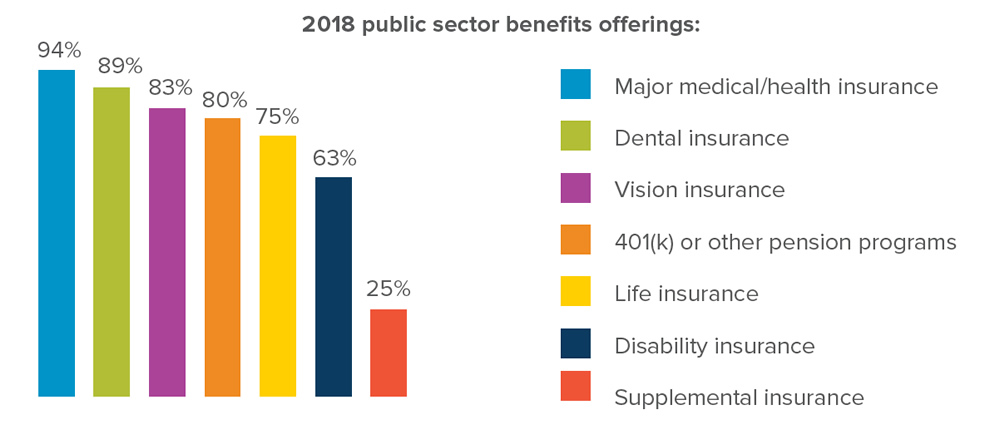

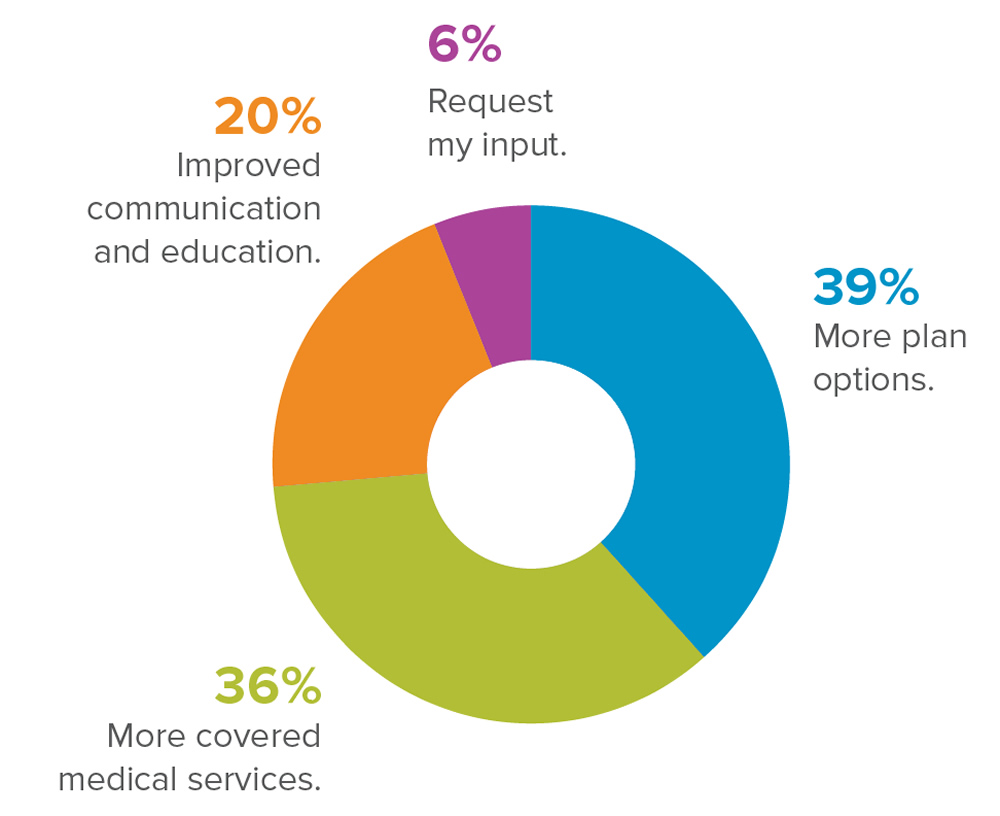

Benefits go a long way to help retain talented employees. While increased salary is the top way to retain employees, “improve my benefits package” ranks second, with 31% of public sector employees saying it would help keep them in their jobs. Other than reduced costs, public sector employees would like to see their benefits package improved by:

4. Communicate clearly throughout the year.

Health insurance can be complex. So, easy-to-understand, regular communication is key for benefits enrollment in the public sector.

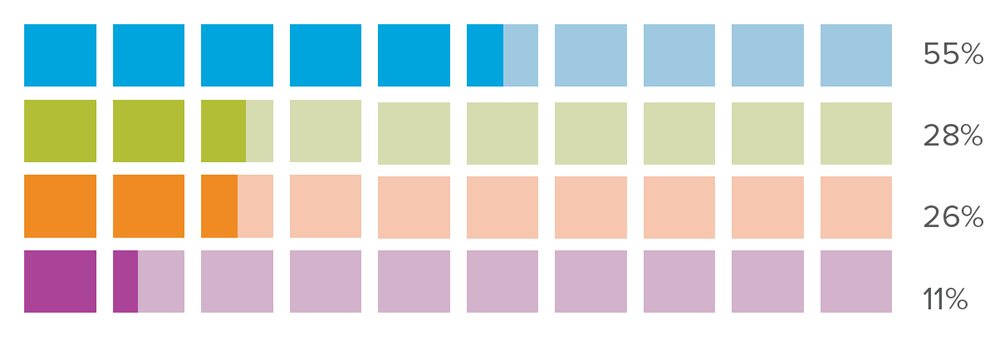

Of employees surveyed:

To improve enrollment, public sector employees say they’d like to see:

Public sector employers choose a variety of methods to manage rising health care costs:

5. Leverage products and services for out-of-pocket cost protection.

Out-of-pocket expenses carry a high cost for public sector employees:

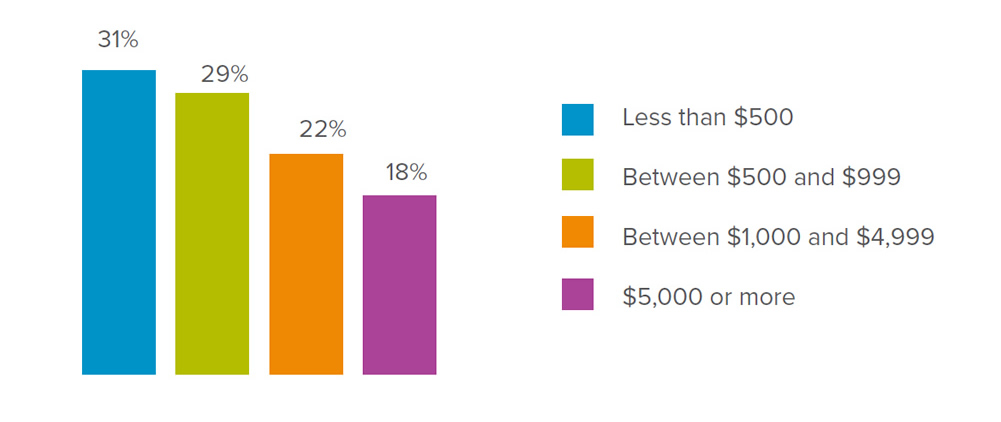

How much could you pay for unexpected out-of-pocket expenses?

Supplemental insurance, such as accident or disability insurance, helps policyholders pay for out-of-pocket costs associated with injury or illness.

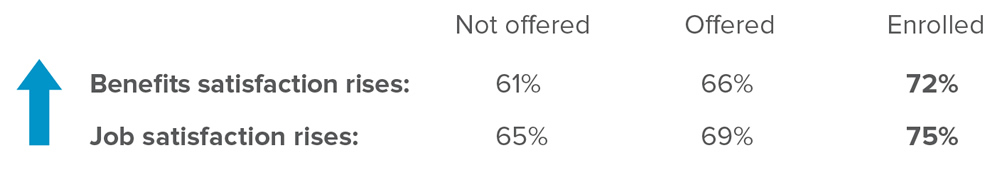

When employees are offered and enrolled in supplemental insurance benefits, job satisfaction improves.3

Top reasons public sector employers offer supplemental insurance:

The 2018 Aflac WorkForces Report is the eighth annual study examining benefits trends and attitudes. The surveys, conducted by Lightspeed, captured responses from 1,700 benefits decision-makers and 2,000 employees across the United States in various industries. The survey results include 375 public sector employees and 195 public sector employers. For more information, visit AflacWorkForcesReport.com.

1 Report extremely or very influential.

2 Report they understand the costs extremely or very well.

3 Data based on a cross analysis of all survey respondents, including public and private sectors.

Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

WWHQ | 1932 Wynnton Road | Columbus, GA 31999

Z190095

EXP 5/20