October 2020

Alston & Bird LLP and Aflac

The Department of Labor and the IRS have issued a notice extending certain deadlines for participants and beneficiaries and plan administrators, including deadlines relating to COBRA, special enrollment rights, and claims and appeals deadlines. This advisory provides a high-level discussion of the extensions as applicable to private sector employer sponsored accident, health and disability plans and what the extensions may mean for employers. Rules specific to church plans and governmental plans are not addressed here. DOL and IRS have also provided FAQs that discuss the extension as well as other issues.

Extension period

The extension period is not a set date, but rather depends on when the National Emergency announced by the President relating to COVID-19 ends. We don’t know at this point when that will be. Under the extension, plans disregard the period between March 1, 2020 and 60 days after the announced end of the COVID-19 National Emergency when calculating the plan-related time periods described below. This period is referred to as the “Outbreak Period” in the DOL/IRS guidance. For example, if the National Emergency were to end on Nov. 30, 2020, the Outbreak Period would end on Jan. 29, 2021.

Under the extension:

Time periods subject to the extension

COBRA notices:

COBRA requirements apply generally to group health plans, however there are important exceptions.

COBRA requirements do not apply to group health plans of small employers. Small employers for this purpose are those that, in the prior calendar year, normally employed less than 20 employees on a typical business day.

In addition, COBRA requirements do not apply to plans that are exempt from ERISA because they qualify under the exception for “voluntary plans”. Many employers make supplemental excepted benefit coverage such as critical illness coverage, hospital indemnity and other fixed indemnity coverage, and vision and dental plans, available to their employees though “voluntary” arrangements to distinguish the benefits from employer-sponsored primary health coverage and retirement plans. These supplemental insurance benefits are often offered by insurers at the worksite and premiums are paid through payroll deduction. If the voluntary plan requirements under ERISA are met, then the arrangement through which supplemental plans are made available by insurers is not subject to ERISA requirements. Thus, if the arrangement qualifies as a voluntary plan under ERISA, then COBRA does not apply. Further information on the ERISA exception for voluntary plans may be found in the Aflac voluntary plan advisory.

The following COBRA deadlines applicable to plan participants and beneficiaries must be applied without regard to the Outbreak Period:

In addition, the plan administrator’s 14-day period for sending COBRA election notices (or the 44-day period if the employer is the plan administrator and sends the notices directly) may be applied without regard to the Outbreak Period. That is, the plan administrator is not required to take advantage of this extension, but the notice is considered timely if the plan administrator does so.

Claims and appeals deadlines; deadline for request of external review

All employee welfare benefit plans subject to ERISA, including group health plans, accident and disability plans, are required to have a process for the filing of claims and initial claims determination, as well as a process by which participants and beneficiaries may appeal a claim that has been denied. ERISA sets forth the details for claims and appeals, including filing deadlines. As discussed above, in some cases, coverage may not be subject to ERISA if the requirements for the voluntary plan exception are satisfied.

In addition, group health plans subject to the ACA are required to have an independent external review process for certain claims. Grandfathered group health plans and excepted benefit plans are not subject to the external review requirements. The deadlines for filing a claim, appeal, or request for external review vary based on the type of claim.

The extension applies to:

HIPAA special enrollment rights

HIPAA generally requires group health plans to provide a special enrollment period during which individuals experiencing certain events and who have previously declined coverage under the plan are allowed to enroll. Examples of circumstances in which a special enrollment period must be available include the following:

The extension applies to the 30-day or 60-day time period to request special enrollment in a group health plan.

Excepted benefit plans (e.g., vision, dental, and Health FSAs) are not subject to the HIPAA special enrollment rules so that the extension is not applicable to these types of plans.

Application of the extension period to different types of plans

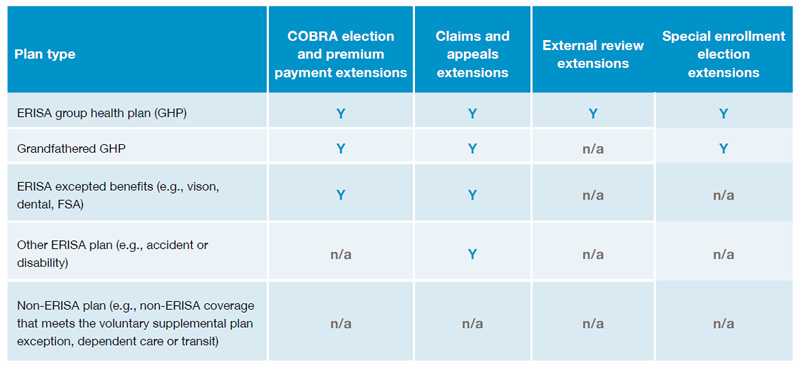

Whether a particular extension applies depends on the type of plan (e.g., whether it is subject to ERISA, whether the plan is a health plan or some other type of plan) and the particular requirement. The following chart provides a highlevel summary of whether the extensions apply to certain types of plans.

Considerations for employer plan sponsors

We don’t know when the National Emergency will be lifted. This means that election periods and payment periods that began or otherwise ended during the Outbreak Period could be open for a very long time— and plans will be required to track those time periods. Thus, plan sponsors and administrators (including COBRA administrators) should discuss these new requirements with their legal advisors. Some high level considerations follow:

Conclusion

The extension was provided in order to assist workers impacted by COVID-19. However, the extensions also create new compliance concerns for plan sponsors. Employers and plan administrators should discuss these issues with counsel in advance to ensure ongoing compliance with their legal requirements during the Outbreak Period.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and individuals should consult their own tax or legal advisers.

Aflac | Aflac New York | WWHQ | 1932 Wynnton Road | Columbus, GA 31999