To flex or not to flex? That is the question. Key details to consider when deciding if a cafeteria plan is right for your business.

By Carolyn Smith and John Hickman, Alston & Bird, LLP

One of the key decisions employers make about employee benefits offerings is whether to provide the benefits through a cafeteria plan, also known as a “flexible benefit” or “flex” plan.

Using a cafeteria plan can have tax advantages for both employers and employees because salary reductions to pay for the benefits are not subject to tax. However, this tax-free option has other consequences, including a number of compliance requirements, and in some cases, it can have an effect on whether benefits paid to the employee are taxed later on.

This article may be of interest to employers of all sizes and explores the issues related to cafeteria plans, focusing on supplemental benefits (also called “excepted benefits”) such as critical illness coverage, hospital indemnity and other fixed indemnity health coverage, specified disease coverage and disability coverage. These insurance policies are supplemental benefits because they are not primary medical coverage or a substitute for major medical insurance.

What is a cafeteria plan?

When many employers hear the term “cafeteria plan,” they may think of arrangements with employer credits and complicated administration requirements. In actuality, these plans are more prevalent than many may think. For federal tax purposes, a cafeteria plan is any employer-sponsored arrangement that allows employees to pay for certain types of benefits on a pretax basis through salary reduction.

As the name “flex” suggests, cafeteria plans can provide considerable flexibility to employers when designing a plan and to employees when choosing from the benefits offered under the plan. With respect to supplemental benefits, a common plan design is a Premium-Only Plan (POP), through which employees pay for the premium through pretax salary reduction. The key advantage of using a cafeteria plan is that the amount of salary reduction used to pay for qualifying benefits is excluded from the employee’s taxable income for federal tax purposes. The salary reduction amount is also excluded from wages for purposes of both the employer and employee shares of payroll taxes, including those from Social Security, Medicare, the Federal Insurance Contributions Act (FICA) and the Federal Unemployment Tax Act (FUTA). Additionally, some employers use a cafeteria plan to offer more expansive benefits, including such things as health and dependent care spending accounts.

These plans are governed by section 125 of the Internal Revenue Code and for this reason are also sometimes referred to as “section 125 plans.” Section 125 imposes a number of different compliance requirements, such as a written plan document and irrevocable elections, in exchange for this favorable tax treatment. Many states, excluding New Jersey and Puerto Rico, provide similar tax benefits as the federal tax rules.

What are the tax consequences of using a cafeteria plan to pay for supplemental benefits?

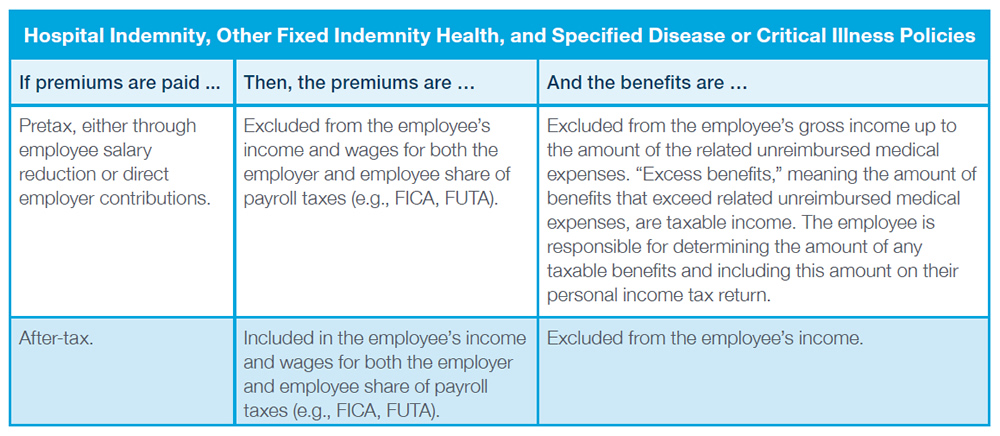

Cafeteria plans offer tax savings on the front end, because premiums for supplemental benefit policies can be paid on a pretax basis. However, in some cases, pretax premiums can have an effect on taxation on the back end when benefits are paid. The rules vary based on the particular coverage, so the charts below provide a summary of tax consequences when premiums for supplemental coverage are paid pretax and after-tax.

Tax rules for fixed indemnity health supplemental products

These policies pay benefits on a cash basis in a fixed dollar amount upon the occurrence of a covered medical event as specified in the policy (e.g., a hospital stay or a diagnosis of a particular illness and treatments for such illness), rather than directly reimburse medical expenses.

For more information on the taxation of fixed indemnity health benefits paid for on a pretax basis, see https://www.aflac.com/business/resources/advisories/clearing-the-air-again-on-taxation-of-fixed-indemnity-health-benefits.aspx.

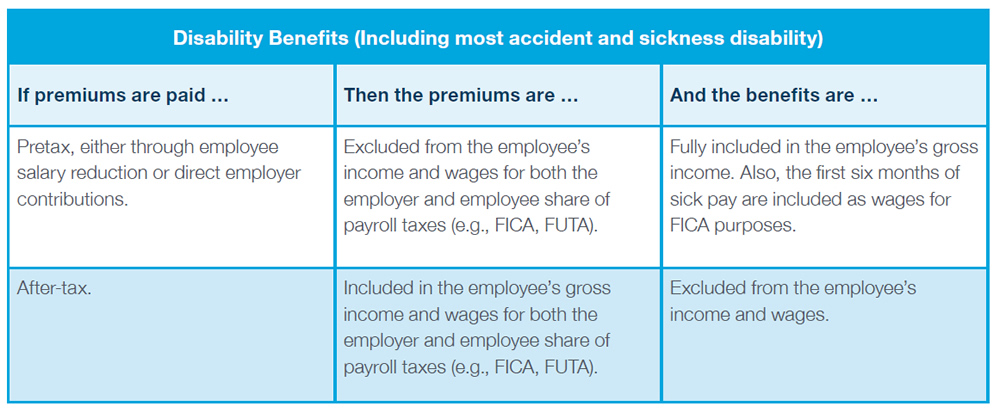

Tax rules for disability benefits

The tax treatment of disability benefits (including most accident and sickness disability) are somewhat different compared to the rules for fixed indemnity health benefits.

What are key compliance issues for a cafeteria plan?

Common circumstances in which mid-year election changes are allowable include:

Note: Absent an event that triggers a permitted change, employees cannot make election changes mid-year. For example, an employee cannot stop salary reduction contributions mid-year merely because the employee decides they don’t want the coverage. There must be a permitted triggering event and stopping the salary reduction must be consistent with that event.

Conclusion

Cafeteria plans can provide flexibility to employers and employees, as well as welcome tax savings. Many employers use cafeteria plans to allow employees to pay for supplemental coverage on a pretax basis, often along with offering other types of qualified benefits. Still, using a cafeteria plan model carries additional administrative and compliance issues. In addition, pretax payment of supplemental benefits premiums can have an effect on the employee’s taxes on the back end. Employers should consult their own tax and benefits plan consultants to determine what is right for them.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and individuals should consult their own tax or legal advisers. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

WWHQ | 1932 Wynnton Road | Columbus, GA 31999.