Final rules eliminate prior restrictions on HRAs and usher in a new era for employer options

By: Carolyn E. Smith and John R. Hickman, Alston & Bird LLP

In response to President Trump’s executive order to expand health reimbursement arrangements (HRAs), the Departments of Labor, Treasury, and Health and Human Services (the “tri-agencies”) recently issued much-anticipated final HRA rules. These rules expand HRAs in ways that could significantly enhance the possibilities for defined contribution health coverage by creating two new types of HRAs, which will be available for plan years beginning on or after Jan. 1, 2020. These options, individual coverage HRAs (ICHRAs) and excepted benefit HRAs (EBHRAs) were not previously permitted. Small and large employers can take advantage of the new HRAs. Small employers will find the new ICHRAs much more flexible than qualified small-employer HRAs (QSEHRAs). For example, ICHRAs preserve the flexibility of employers to offer supplemental coverage in addition to the ICHRA.

This article provides a summary and comparison of the new rules and HRA options. It addresses basic requirements, reimbursable (and nonreimbursable) expenses and how the new HRAs fit with other health benefit options (e.g., health savings accounts and supplemental coverage). The new rules are extensive and contain details not discussed here.

Background

HRAs are a type of defined contribution group health plan funded solely by the employer. Therefore, employee contributions – whether before or after tax – are not permitted. Each year, the employer determines the amount that is made available to pay for medical expenses through the HRA. Expenses that qualify for reimbursement include certain health insurance premiums and out-of-pocket medical expenses that aren’t paid by insurance. Reimbursements of medical expenses from an HRA are not subject to tax. If permitted under the HRA, unused amounts at the end of the year may be carried over and used to reimburse medical expenses in later years (including post-retirement).

Following the enactment of the Affordable Care Act (ACA), tri-agency rules restricted the types of HRAs that could be offered to active employees. The tri-agency rules only allowed employers to offer HRAs integrated with other (non-HRA) group health plan coverage. Therefore, HRA funds could not pay for individual market health insurance. The older tri-agency guidance also prohibited an employer from offering an HRA to employees who were not enrolled in non-HRA group coverage. Note: These restrictions did not apply to retiree-only HRAs, because retiree-only health plans are not subject to the ACA.

Congress provided some relief from this early tri-agency guidance by creating qualified small-employer HRAs (QSEHRAs). Through a QSEHRA, small employers (in general, employers with fewer than 50 full-time equivalent employees) can help employees pay for individual market coverage. However, the QSEHRA rules are somewhat complicated and restrict employer flexibility, so they aren’t very popular with employers. Also see: A general discussion of QSEHRAs.

Fast forward to Oct. 12, 2017, when President Trump issued an executive order reflecting a new view on the ACA and directing the tri-agencies to issue new guidance that expands access to HRAs. The recent final rules reverse the earlier guidance and create two new types of HRAs, available to employers of any size: individual coverage HRAs and excepted benefit HRAs.

2 new types of HRAs

Individual coverage health reimbursement arrangements (ICHRAs)

What is and isn’t considered qualifying individual market coverage?

To be eligible for an ICHRA, an individual must be enrolled in qualifying individual market coverage. This includes coverage purchased on or off an ACA exchange, grandfathered coverage and grandmothered (or “transition”) coverage, and Medicare. On the other hand, short-term limited duration insurance (STLDI) and coverage consisting only of excepted benefits (e.g., dental, vision, specified disease) are not considered qualifying individual market coverage.

What is considered a traditional group health plan?

A traditional group health plan means any group health plan other than (1) an HRA or another account-based plan or (2) a plan consisting only of excepted benefits (e.g., specified disease coverage, hospital indemnity or other fixed indemnity health excepted benefits, dental or vision coverage).

An employer cannot offer the same class of employees both an ICHRA and a traditional group health plan. On the other hand, EBHRAs can only be offered to employees who are eligible to participate in a traditional group health plan offered by the employer (but the employee does not have to enroll in the traditional group health plan).

As the name suggests, through an ICHRA, employers can help employees pay for premiums for qualifying individual market major medical coverage and out-of-pocket medical expenses not reimbursed by insurance. To be eligible for an ICHRA, the employee (and spouse or dependents, if covered by the ICHRA) must enroll in qualifying individual market coverage. ICHRAs are sometimes referred to as “integrated” with individual major medical coverage because the HRA relies on the individual coverage to satisfy certain ACA requirements, including the prohibition on annual and lifetime dollar limits on essential health benefits.

In order to help reduce the risk of “cherry picking” and individual market segmentation, an employer cannot offer both a traditional group health plan and an ICHRA to the same class of employees.

Because ICHRAs are dependent on individual market coverage, the ultimate popularity of these plans may depend on the quality and number of options available in the individual major medical market.

Excepted benefit health reimbursement arrangements (EBHRAs)

EBHRAs are designed to reimburse certain medical expenses for employees who are eligible to participate in a traditional group health plan offered by the employer. The employee does not have to be covered under the employer’s traditional group health plan but must be offered the plan.

How did EBHRAs get their name?

The term “excepted benefit” was added to federal law when HIPAA was enacted back in 1996 and has carried through without change under the ACA. Like other categories of “excepted benefits,” EBHRAS are excepted from the ACA requirements. ICHRAs, however, are subject to the ACA, which is why they are subject to more extensive rules than EBHRAs.

Note: Unfortunately, the use of the term “excepted benefit” to describe the new HRAs can be somewhat confusing. It is important to note that EBHRAs are not restricted to paying only for excepted benefits. In fact, EBHRAs can pay for non-excepted medical expenses. Additionally, EBHRAs cannot pay for all categories of health-excepted benefits. A detailed look at what EBHRAs can cover is below under qualifying expenses.

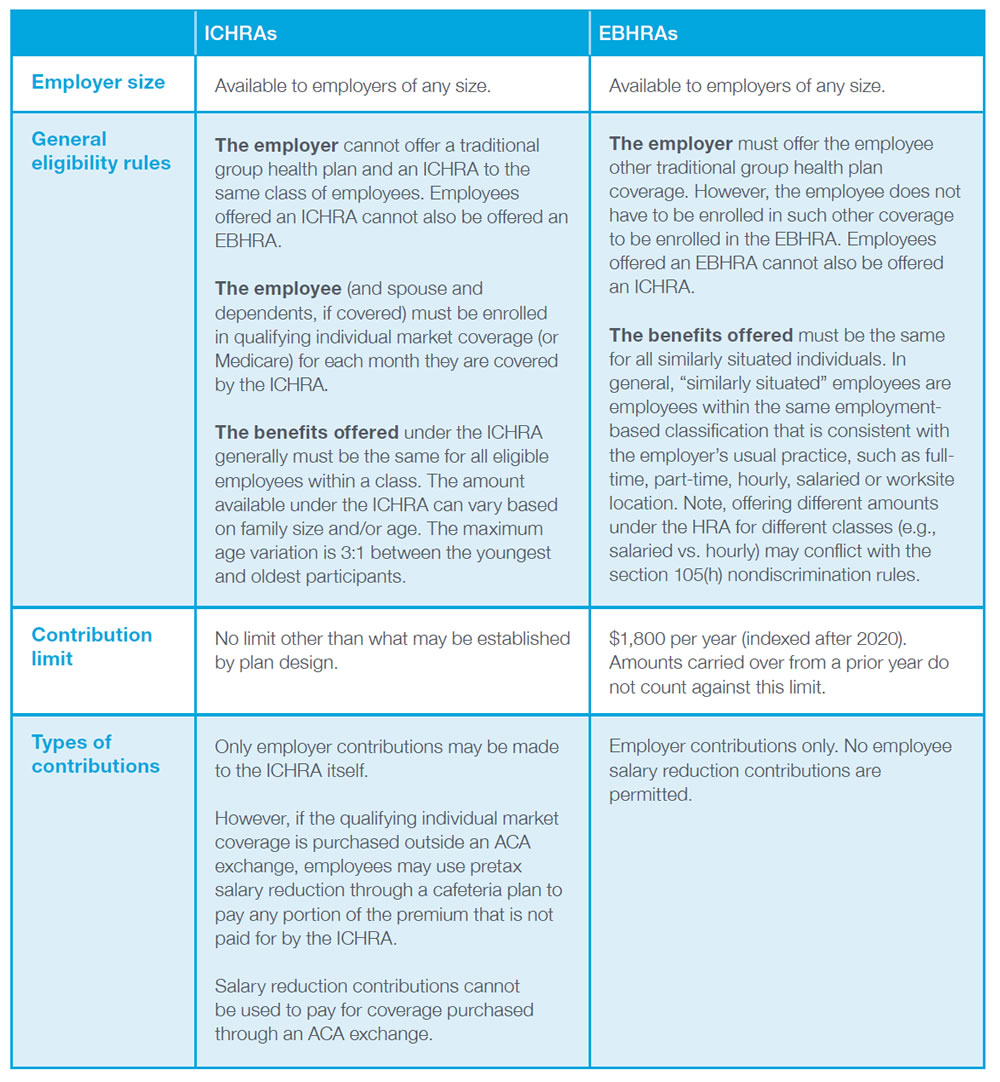

ICHRAs and EBHRAs – comparison of basic requirements

The following table provides a high-level overview and comparison of the basic requirements for ICHRAs and EBHRAs.

Qualifying expenses

Section 213 medical expenses only, please

As a threshold matter, HRAs, including ICHRAs and EBHRAs, can only reimburse expenses that qualify as a medical expense under the federal tax laws, referred to as Section 213 medical expenses. Section 213 medical expenses include out-of-pocket expenses for medical care that are not covered by insurance, such as copayments, deductibles and expenses for noncovered services. Premiums for insurance that provides medical care is also a Section 213 medical expense. Under current IRS rules, premiums for fixed indemnity health coverage that pays a fixed benefit based on a triggering medical event, but not on an expense-incurred basis, does not qualify as a Section 213 medical expense. Therefore, funds from ICHRAs and EBHRAs (or any other HRAs) cannot pay for premiums for fixed indemnity health coverage (e.g., insurance that pays a predetermined amount on a per-period or per-incident basis, regardless of the total charges incurred).

Specific rules for ICHRAs and EBHRAs

ICHRAs and EBHRAs have different purposes, so there are some differences between the types of Section 213 medical expenses that may be paid though each.

ICHRAs are specifically designed to provide primary health coverage by reason of being integrated with individual market ACA-compliant coverage. Thus, ICHRAs can be used to pay premiums for such individual market coverage, as well as out-of-pocket medical expenses and premiums for excepted benefit coverage that qualifies as a Section 213 medical expense. The plan sponsor, as a matter of plan design, can limit the types of expenses that can be reimbursed, for example, to make the ICHRA compatible with health savings accounts (HSAs).

A plan sponsor may make an ICHRA compatible with an HSA by limiting permitted reimbursements to individual market premiums for a high-deductible health plan.

EBHRAs, on the other hand, as excepted benefits, are not designed to provide primary health coverage or be integrated with another health plan. Thus, EBHRAs generally cannot reimburse premiums for individual or group health plan coverage or Medicare. However, EBHRAs can reimburse premiums for group or individual excepted benefit coverage that qualifies as a Section 213 medical expense, as well as COBRA and other continuation coverage. EBHRAs can also be used to reimburse out-of-pocket expenses not covered by insurance.

Overall benefit design issues

ICHRAs and EBHRAs can be part of a broader array of health benefit options offered by employers. An employer that offers an ICHRA to a class of employees may offer the same employees a health flexible spending account (FSA) and/or excepted benefit coverage, including dental, vision, hospital indemnity and other fixed indemnity health coverage, specified disease coverage, and accident/disability coverage. Similarly, an employer that offers employees an EBHRA may also separately offer excepted benefit coverage or an FSA outside the EBHRA. Such excepted benefit coverage may be paid for either after-tax by the employee or on a pretax basis by the employer or by employee salary reduction through a cafeteria plan outside the ICHRA. Also see: More information on cafeteria plans and related tax issues.

Conclusion

The two new HRAs will give employers, especially smaller to mid-size employers, much more flexibility with respect to the health plan coverage that they make available to employees. For example, employers who desire to offer part-time employees health coverage, but who otherwise could not afford to offer coverage, may now be able to offer an ICHRA to such employees. The two new designs also, unlike QSEHRAs, preserve the flexibility to offer supplemental excepted benefits, such as specified disease and hospital indemnity and other fixed indemnity health coverage, alongside the ICHRA or EBHRA. The two new HRAs will provide additional options as employers determine what health coverage plan is best for them.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees and other individuals should consult their own tax or legal advisers about their situation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999