You and your colleagues are called to serve. But just like anyone striving to make a living, public sector employees need to know what's in it for them.

Enter you: the expert who is skilled at balancing people's desire to serve with their desire to do what's best for them.

At a time when it appears that trust in institutions is falling, your ability to earn employees' trust by showing them that you understand their needs is more important than ever.

“What's in it for me?”:

How you speak to employees' need for robust benefits

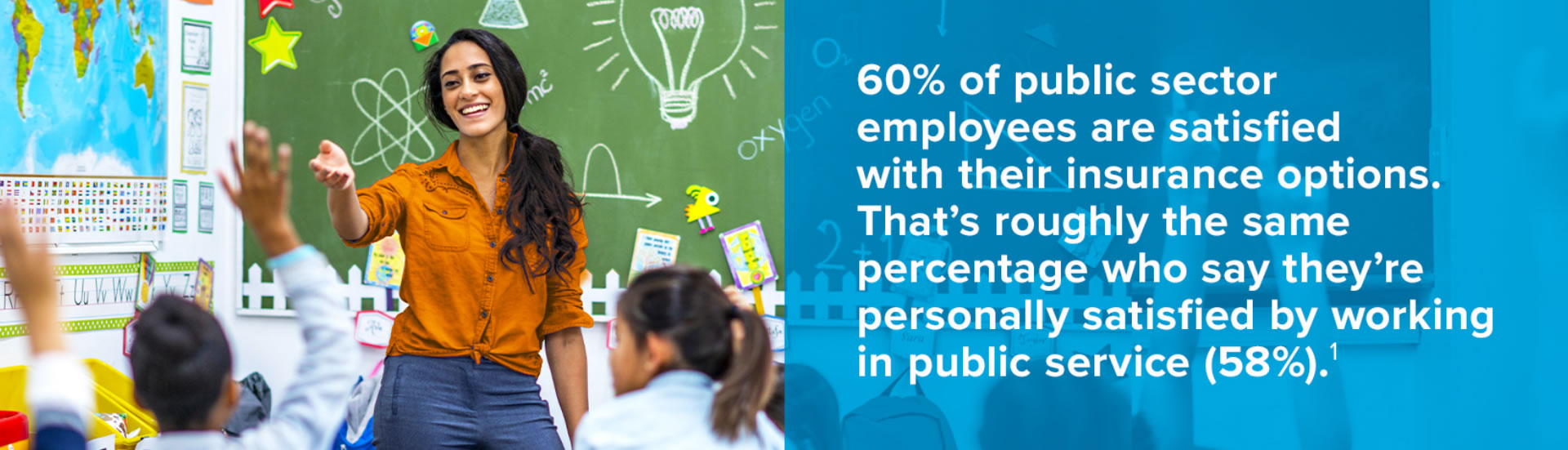

You and your colleagues are driven to serve, but this isn't volunteer work. You all need compensation and benefits that compete with those of private sector jobs: Higher salary or better benefits are the No. 1 reason government employees consider changing jobs, above burnout, stress, lack of satisfaction, desire for remote work and other opportunities.1

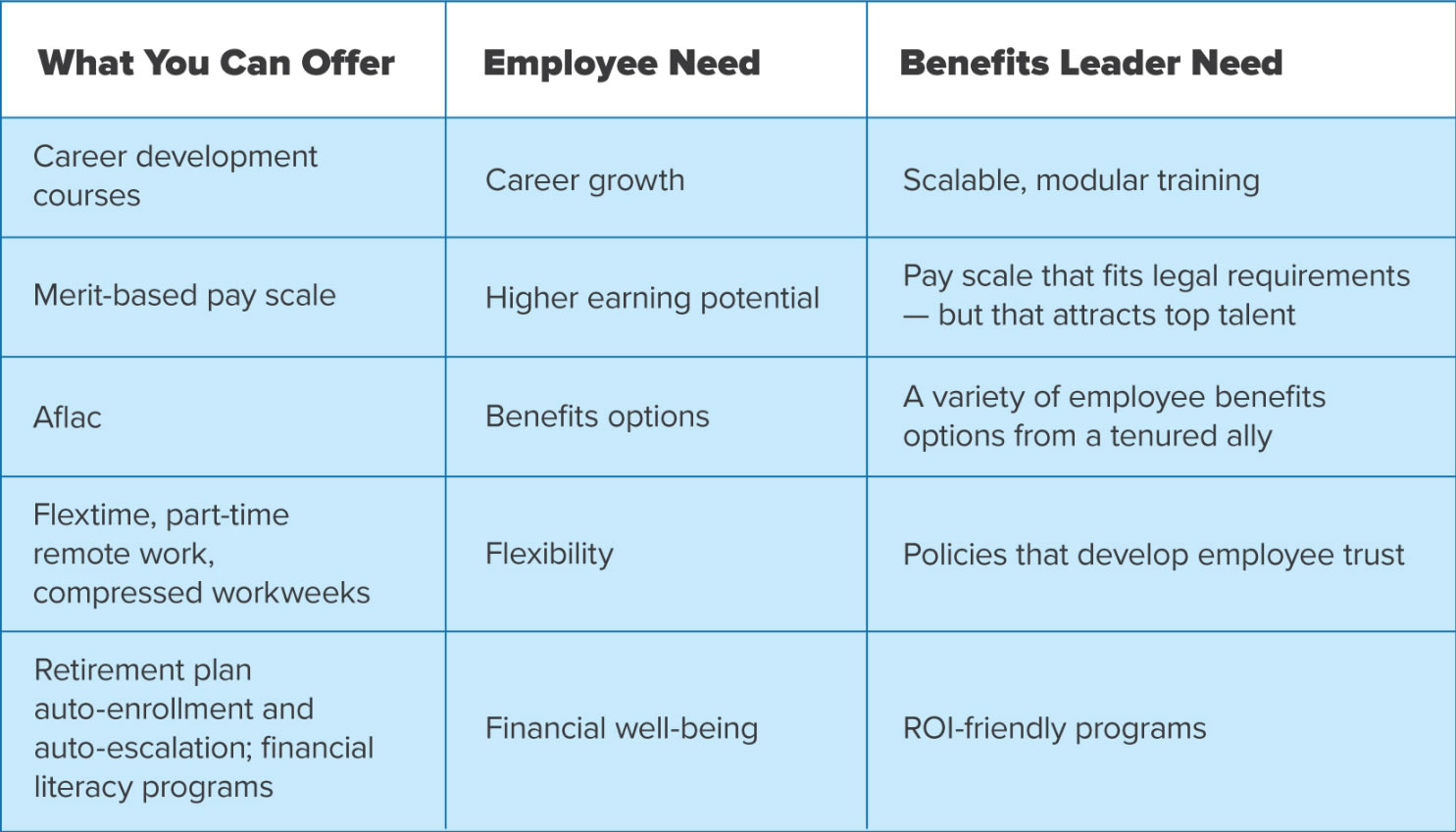

There's only so much control you have over budgets. But you've figured out how to work with what you've got. You've developed programs geared toward flexibility, nontraditional benefits and financial wellness. You've seen merit-based pay scales take hold in some fields, and you've figured out how to attract younger talent.

of public sector benefits decision-makers use flextime to address workplace flexibility, and 55% use part-time remote work.3

such as tuition assistance and child care support are a bigger draw for public sector employees under 40 than for older ones.1

public sector benefits decision-makers offer at least one financial well-being program or resource.3

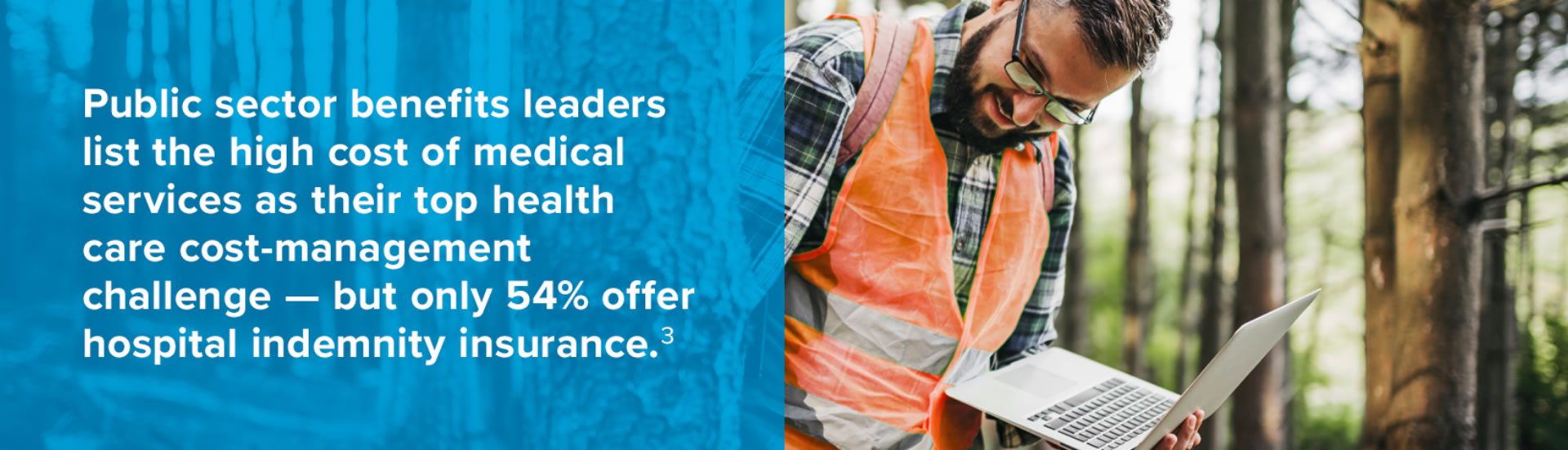

You've looked at what keeps people from thriving, and you've recognized the struggle: 77% of public sector employees who are in debt say their debt prevents them from saving more for retirement.1 And knowing that medical debt is a leading cause of non-mortgage debt in the United States,4 you've found part of the solution to medical debt: robust health benefits that go beyond health insurance, and that come at a fair cost to you and your workforce.

of public sector employees say that insurance benefits beyond health insurance are a major factor in why they took their current job.1

of public sector benefits leaders did not increase employee cost sharing at their most recent health insurance renewal.3

public sector benefits leaders offer supplemental benefits.3

Still, there are more places you can go at little or no cost to you. Customized options that speak to the unique needs of your people, such as special benefit options for first responders and tenure benefits for educators. Value-added services that can help support mental health and telemedicine for your time-crunched employees. Hospital insurance that can help get to the heart of your own challenges with managing medical costs.

“In the service of others”:

How public sector work is set apart

Of course, employees everywhere want good benefits – particularly given that in the U.S. health care system, people's health insurance is often tied to employment.

But there's something that the benefits decision-makers in other fields don't have as a part of their mission: being part of a group whose work is driven by a higher aspiration, serving the public. With that mission comes a purpose, pride and fulfillment.

Even when the tasks of the day are dreary. Even when the days feel too long and the weekends feel too short. Even when there aren't weekends at all.

Fifty-six percent of public sector employees say that the personal satisfaction they get from their job is a major reason they wanted their job in the first place.1 That's not something people in general can say: 27% of Americans say their job isn't central to their identity.5

-Woodrow Wilson, 28th U.S. President

The perception of public service may ebb and flow over the years, but employees know that there's more to the story. Even at a time when trust in public institutions seems to be falling, 66% of public sector employees report positive work morale.1 That doesn't mean that every public sector employee loves their job. What it does mean is that they likely know there's more to it than clocking in and clocking out.

You've developed solutions that meet your needs – and there's more on the horizon

As a leader in your field, you see the full spectrum of what drives people to this work, and you've become adept at finding solutions to speak to those needs. Whether it's redefining the way some government employees are paid so that innovators can draw a competitive salary, devoting resources to flextime solutions that support working parents, or bringing in a suite of Aflac products that offer robust supplemental insurance options at little or no cost to you, you've relentlessly found ways to help attract and maintain the talent that makes our world go round.

Your full-spectrum approach to nurturing talent works – in part because you yourself were likely drawn to public service both for its unique nature and its opportunities.

Many people will always be drawn to serve, and the public will always depend on that special class of people. But you'll need tools to help demonstrate that a life in public service can speak not just to people's need to serve but to their financial and well- being needs.

Aflac can be a critical part of that tool kit, thanks to our experience in working with more than 30,000 public sector organizations to help make sure employees have the customized benefits options they need. The more expansive and creative your tool kit, the better you'll be able to serve the people who serve. And as a result, the more people – we, the people – can thrive.

Let's get your public sector employees the coverage they need. Request a call with a trained benefits advisor to get started.

1 MissionSquare Research Institute. “State and Local Government Employees: Morale, Public Service Motivation, Financial Concerns, and Retention.” Published March 2023. Accessed 8.23.2023. https://slge.org/wp-content/uploads/2023/02/59976-slg-worker-report_final.pdf.

2 MissionSquare Research Institute. “The Great Resignation and COVID-19: Impact on Public Sector Employment and How Employers Can Help.” Published 2022. Accessed 8.23.2023. https://slge.org/wp-content/uploads/2022/01/greatresignationinfographic.pdf.

3 Gallagher. “2022 Workforce Trends Report Series: Public Entity.” Published 2022. Accessed 8.23.2023. https://www.ajg.com/us/-/media/files/gallagher/us/news-and-insights/workforce-trends-report-2022-public-entity-addendum.pdf.

4 Statista. “Leading sources of non-mortgage debt among consumers in the United States in 2023.” Published July 2023. Accessed 9.1.2023. https://www.statista.com/statistics/944954/personal-debt-source-usa/.

5 Pew Research Center. “How Americans View Their Jobs.” Published 3.30.2023. Accessed 8.23.2023. https://www.pewresearch.org/social-trends/2023/03/30/how-americans-view-their-jobs/.

This article is for informational purposes only and is not intended to provide tax, legal, health or financial advice for any person or for any specific situation.

Aflac coverage may not be available in all states, including but not limited to ID, NJ, NM, NY, or VA. Benefits/premium rates may vary based on plan selected. Optional riders may be available at an additional cost. Plans and riders may also contain a waiting period. Refer to the exact plans and riders for benefit details, definitions, limitations and exclusions. For availability and costs, please contact your local Aflac agent.

Group coverage is underwritten by Continental American Insurance Company (CAIC), which is not licensed to solicit business in Guam, Puerto Rico, or the Virgin Islands. In California, group coverage is underwritten by Continental American Life Insurance Company. In New York, coverage is underwritten by Aflac New York.

Individual coverage underwritten by American Family Life Assurance Company of Columbus. In New York, individual coverage underwritten by American Family Life Assurance Company of New York:

Cancer/Specified-Disease: B70000 series - In Delaware, Policies B70100DE, B70200DE & B70300DE. In Idaho, Policies B70100ID, B70200ID, B70300ID, B7010EPID, B7020EPID. In Oklahoma, Policies B70100OK, B70200OK, B70300OK, B7010EPOK, B7020EPOK. A75000 series - In Virginia, policies A75100VA–A75300VA.

Accident: A36000 series - In Delaware, Policies A36100DE—A36400DE, & A363OFDE. In Idaho, Policies A36100ID–A36400ID, & A363OFID. In Oklahoma, Policies A36100OK– A36400OK, & A363OFOK. In Virginia, Policies A36100VA – A36400VA, & A363OFVA. A37000 series - In Delaware, Policy A371AA & A371BA. In Idaho, Policy A37000ID. In Oklahoma, Policy A37000OK. In Virginia, Policies A371AAVA & A371BAVA.

Short-Term Disability: In Delaware, Policies A57600DE & A57600LB. In Idaho, Policy A57600IDR. In Oklahoma, Policies A57600OK & A57600LBOK. In Virginia, Policies A57600VA & A57600LBVA.

Hospital Insurance: In Delaware, Policies B40100DE & B4010HDE. In Idaho, Policies B40100ID & B4010HID. In Oklahoma, Policies B40100OK & B4010HOK. In Virginia, Policies B40100VA & B4010HVA.

Critical Illness: In Delaware, Policies A74100DE, A74200DE, A74300DE. In Idaho, Policies A74100ID, A74200ID, A74300ID. In Oklahoma, Policies A74100OK, A74200OK, A74300OK. In Virginia, Policies A74100VA, A74200VA, A74300VA.

Aflac’s affiliation with the Value-Added Service providers is limited only to a marketing alliance, and Aflac and the Value-Added Service providers are not under any sort of mutual ownership, joint venture, or are otherwise related. Aflac makes no representations or warranties regarding the Value-Added Service providers, and does not own or administer any of the products or services provided by the Value-Added Service providers. Each Value-Added Service provider offers its products and services subject to its own terms, limitations and exclusions. Services, Terms and conditions are subject to change and may be withdrawn at any time. The value-added services may not be available in all states, and benefits/services may vary by state.

Aflac’s family of insurers includes Aflac, Aflac New York, Continental American Insurance Company and/or Continental American Life Insurance Company.

Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999

Aflac New York | 22 Corporate Woods Boulevard, Suite 2 | Albany, NY 12211

Continental American Insurance Company | Columbia, SC

Z2300980

EXP 9/24