By Carolyn Smith and John Hickman, Alston & Bird, LLP

The president issued an executive order in October focusing on ways to enhance benefits under Medicare. This article provides a high-level overview of the proposals outlined in the EO. It also discusses potential exposure to out-of-pocket expenses and options to help individuals plan for such expenses, including the role of supplemental health benefits.

Background

In an earlier article, we addressed some current high-profile legislative proposals relating to Medicare, commonly referred to as “Medicare for All” proposals. These proposals are designed to expand eligibility for Medicare to allow more individuals to have Medicare or a Medicare-like plan as their primary health insurance. Some proposals would allow older individuals, age 50 and 55 or older, to enroll in Medicare. Others are more expansive and would allow all individuals to enroll in Medicare.

The president’s latest EO focuses on regulatory changes to the existing Medicare program, including possible changes to both traditional Medicare — often called original Medicare — and Medicare Advantage. Traditional Medicare is a fee-for-service program under which the federal government pays health care providers directly. Private insurance companies that contract with the federal Medicare program offer MA plans. Our earlier article provides a high-level overview of the differences and similarities between traditional Medicare and MA plans. Data from the federal agency that oversees Medicare indicates that roughly two-thirds of those with Medicare are enrolled in traditional Medicare and one-third are enrolled in MA plans.

The president’s EO on Medicare

The EO directs the federal Department of Health and Human Services to take action to accomplish a number of goals, including:

Because the EO is new, specific regulations aren’t proposed in these areas yet, but HHS is expected to act fairly quickly in response to the president’s direction.

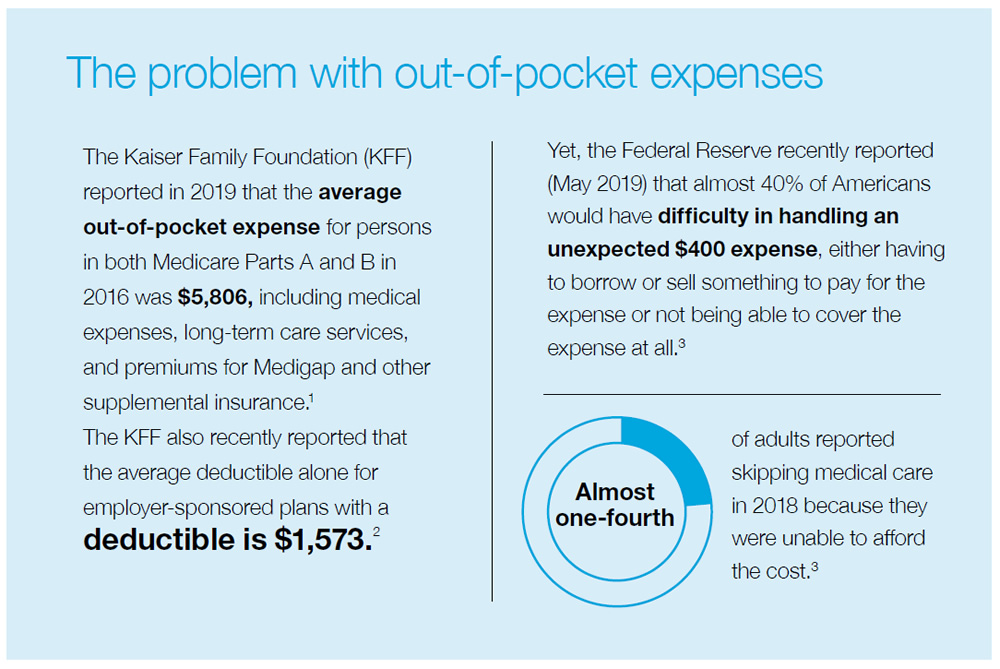

The reality of out-of-pocket expenses

The practical reality is that individuals face health-related out-of-pocket expenses regardless of their primary health insurance. Some of the common circumstances that result in out-of-pocket expenses in addition to premiums for health insurance include the following:

Addressing out-of-pocket health-related costs

One way to plan for health-related costs is through supplemental insurance policies. Supplemental coverage is designed to provide an additional layer of financial protection in the case of an accident or illness. These types of policies aren’t intended to serve as primary health insurance or a substitute for such coverage. For this reason, federal and state law has long recognized these plans as “excepted benefits.” They are generally “excepted” from requirements that apply to health insurance, including the Affordable Care Act requirements. Note: These policies are different from Medigap policies, which are regulated at both the federal and state level and are specifically designed to fill in the gaps in traditional Medicare coverage.

Dental and vision coverage

Health insurance often does not cover dental exams, eye exams and corrective lenses, and other related services other than certain preventive pediatric services. Traditional Medicare does not cover these services; some MA plans, however, do provide such coverage. In the employment-based health care market, vision and dental are often offered by employers through what is known as supplemental or “stand-alone” coverage that is limited to dental or vision care.

Stand-alone dental or vision coverage is generally available in a number of forms:

Other types of supplemental coverage

Other types of supplemental coverage include:

Unlike typical health insurance, these policies generally pay a cash benefit triggered by a covered accident or illness unrelated to the amount of expenses incurred. This cash benefit can be used for any purpose as determined by the policyholder, whether to help compensate for the out-of-pocket costs that add up even with health insurance or for other financial needs. Thus, this type of policy provides financial protection due to an accident or illness that is flexible to meet the needs of the policyholder.

Conclusion

Regardless of what changes, big or small, lie ahead for our health care system, one reality is that there will always be expenses that health insurance doesn’t cover. Supplemental benefits, including dental and vision coverage, specified disease, critical illness, hospital indemnity and other fixed indemnity health excepted benefits, are one way individuals can help reduce exposure to unexpected costs.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees and other individuals should consult their own tax or legal advisers about their situation.

Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.

1 The Kaiser Family Foundation (2019). An overview of Medicare. Accessed from https://www.kff.org/medicare/issue-brief/an-overview-of-medicare/.

2 The Kaiser Family Foundation (2019). 2019 employer health benefits survey. Accessed from https://www.kff.org/report-section/ehbs-2019-summary-of-findings/.

3 Board of Governors of the Federal Reserve System (2019). Report on the economic well-being of U.S. households in 2018 – May 2019. Accessed from https://www.federalreserve.gov/publications/2019-economic-well-being-of-us-households-in-2018-dealing-with-unexpected-expenses.htm.

N190590

EXP 10/20