Important details about investing in health care benefits for employees through a defined contribution model

As health care costs continue to rise, consumer-driven options are taking center stage to help individuals and families make smart decisions about how their health care dollars are spent. One way employees are gaining more choice is through defined contribution. Defined contribution for health care benefits has advantages for employers by helping them to control the amount they pay toward benefits, and it allows employees to choose the products and plans that are right for them. Below are frequently asked questions and answers to help employers navigate the ins and outs of putting a defined contribution model in place.

What is defined contribution for health care benefits?

Similar to an allowance, through defined contribution, employees receive a discretionary stipend from their employer to spend on health insurance, including major medical insurance and other types of health benefits that they choose. If the employee wants more robust coverage than their employer’s contribution can cover, the employee can choose to pay the remaining portion of the bill.

Why choose a defined contribution model?

Making a defined contribution gives employees ownership over the benefits that they purchase so that they can make the right choices for their unique situation. Additionally, defined contribution can allow employers to control costs by setting the amount put toward benefits ahead of time, leaving less room for employers to be surprised by additional costs, like rate increases, or changes in plan availability. For employers who want to help their employees with the cost of insurance but cannot cover the entire amount, defined contribution can be a beneficial middle ground for the employer and its employees.

How can employers implement a defined contribution stipend?

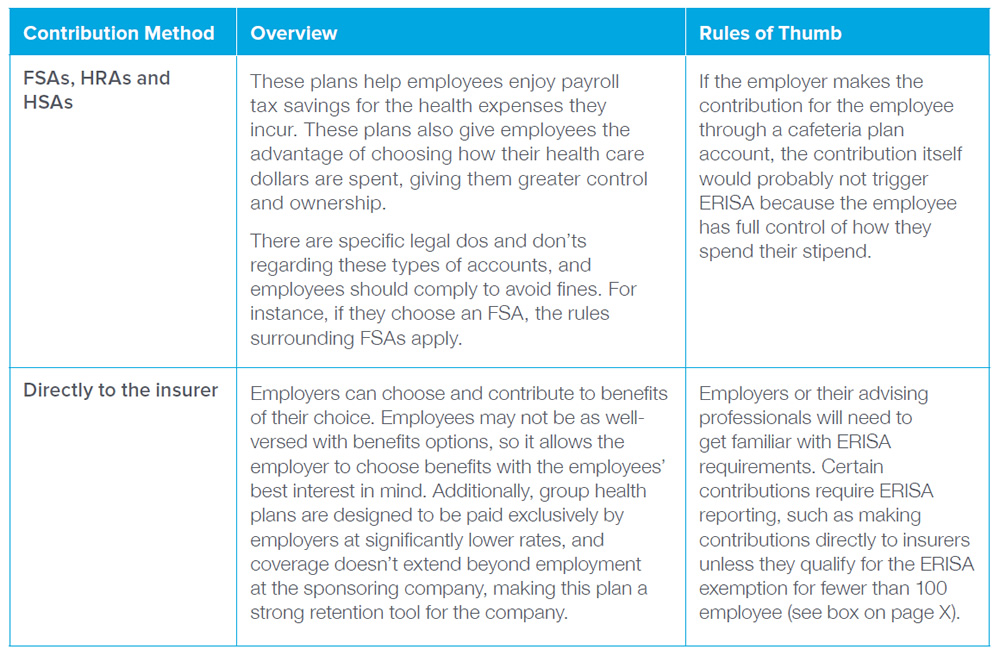

Employers can be creative with the method they use for defined contribution. Whether by deposit in a health savings account, flexible spending account, health reimbursement account or making a contribution directly to the insurer, there are multiple ways for employers to provide their employees with a stipend for health care benefits.

To whom does an employer need to provide a health benefit defined contribution stipend?

There isn’t a specific ERISA or Internal Revenue Code requirement that an employer offer the same employer contribution (i.e., non-salary reduction) to each employee for Aflac products, Aflac partner products and value-added services. So, employers can use discretion with contribution amounts and the type of contribution across their workforce. For example, an employer can offer to make contributions toward Aflac products for some employees and not others or can vary contribution levels or amounts for different classifications of employees (e.g., by job classification, part-time, fulltime). There are no special requirements for seniority. With this in mind, employees are protected by anti-discrimination laws and rules. Federal employment laws prohibit discrimination based on certain factors, such as sex (e.g., an employer could not make different contributions for female and male employees), disability, race, religion and ethnic origin. The federal nondiscrimination requirement with respect to age generally allows higher premium rates based on actuarially sound underwriting practices. If the employer is a federal contractor or receives federal financial assistance such that ACA section 1557 applies, there may be additional restrictions for the employer to comply with.

Simply put, if an employer wants to offer different contribution amounts to employees, it should first carefully consider whether there’s a legitimate business reason for doing so. If the employer has a sound basis (i.e., it doesn’t want to offer coverage to part-time employees), that’s fine. Otherwise, if there’s no bona fide business reason, it could be viewed as unlawful discrimination.

Important note for plans issued in the state of New York

If an employer chooses a defined contribution model in New York, the employer must provide contribution dollars in a manner that gives their employees full discretion and control over how the dollars are spent. Otherwise, if the employer sponsors or exercises control of the contribution, franchise insurance is required by New York insurance regulations. Aflac carries specific franchise versions of our products, including accident (NY35000F series), hospital indemnity (NY46000F and NYB40000F) and cancer (NY76000F). In order to offer a defined contribution that is not subject to franchise insurance rules, these employers may consider a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA), FSA or HSA.

About ERISA

If an employer has questions about Employee Retirement Income Security Act (ERISA) applicability, that employer should discuss its specific situation with an ERISA expert. Usually, this will be a legal expert specializing in ERISA benefits plans.

ERISA provides various protections and rights to participants of an employee welfare benefit plan that is established or maintained by an employer or an employee organization. This type of arrangement is typically referred to as a group health plan. And it’s not limited to major medical insurance. It expands to any type of health insurance benefit, including dental, vision and indemnity insurance, among others. For example, if an employer (or plan administrator, if acting on behalf of the employer) offers a group health plan to its employees, the employer (or plan administrator, if acting on behalf of the employer) is responsible for providing a summary plan description (SPD) to the employees, even if the only products offered are Aflac products. For employers with 100 or more employees, there are reporting requirements under Form 5500 Schedule A.

Defined contribution and ERISA:

Regarding a defined contribution arrangement, if an employer chooses to exercise control over the defined contribution arrangement, it will likely be considered a group health plan, and the employer will need to comply with ERISA plan requirements. Examples of “exercising control” are choosing which product is purchased or paying the insurance provider directly.

ERISA Reporting Exemptions

ERISA includes several requirements related to plan documents, claims, appeals procedures, reporting and more. For some small employers, there is a full exemption from the requirement to file Form 5550 if all four of the following conditions are met:

Finding the best way to invest in employees’ well-being is an important decision for any business. A defined contribution model can help to control costs and give employees more choice in deciding which benefits are right for them. To reap the rewards of any benefits model, don’t do it alone. Be sure to lean on your team of tax, legal and benefits professionals to decide on the right benefits options for your business.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers should consult their own tax or legal advisors regarding defined contribution and applicable ERISA requirements. This article is for informational purposes only and is not intended to be a solicitation. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.