Under the Affordable Care Act, employers who self-fund their employee health care are required to submit informational reporting about minimum essential coverage to the Internal Revenue Service. To help businesses comply with this requirement, Aflac has outlined the details you need to know:

Under the Affordable Care Act, employers who self-fund their employee health care are required to submit informational reporting about minimum essential coverage to the Internal Revenue Service. To help businesses comply with this requirement, Aflac has outlined the details you need to know:

Among those required to submit information reporting of minimum essential coverage are:

Note: Applicable large employers that self-fund their health care are also required to submit employer sponsored coverage reporting to the IRS. To learn more, see Employer-Sponsored Coverage to the IRS Information Reporting.

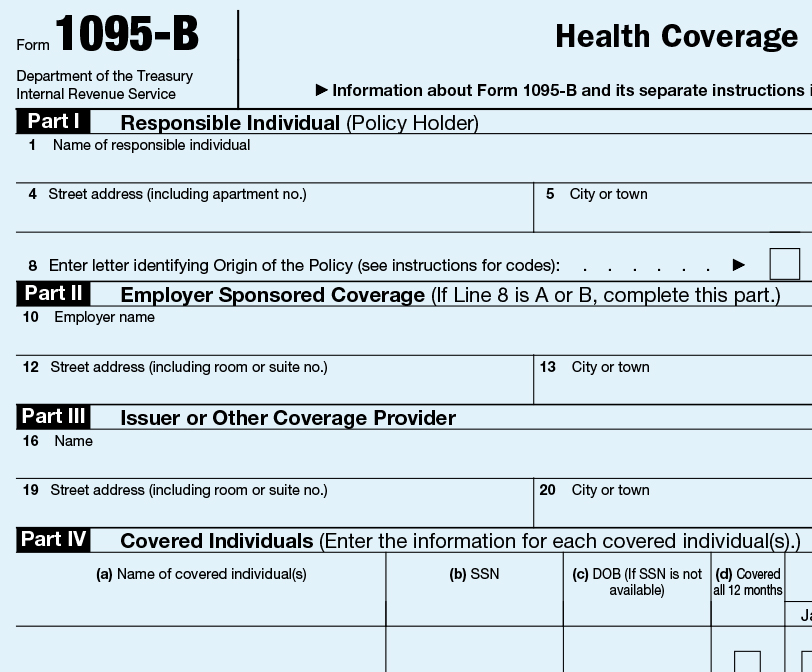

Employers are required to submit a separate report for each individual health care recipient on Forms 1095-B and 1094-B that specifically provides:

The employer must also provide a written statement to the covered individual(s) that includes:

Similar to the applicable W-2 reporting deadline, statements are to be provided annually to employees by Jan. 31. Forms must be provided to the IRS by Feb. 28 (March 31 if filed electronically) for the previous calendar year.

Employers are required to provide the IRS with Form 1094-C, which is the transmittal form, and Form 1095-C, which is the employee statement. Employers can file electronically, and draft forms are expected to be available from the IRS as the reporting deadline approaches.

Yes, the law allows employers to use a third party to assist with filing IRS reporting and providing statements to individuals insured by the health plan.

Currently, employers may face penalties for not filing informational reporting. However, the law explains that these fines may be waived for employers that do not file due to reasonable cause, or fines reduced for errors that are corrected in a timely manner that are not due to reasonable cause.

This material is intended to provide general information about an evolving topic and does not constitute legal, tax or accounting advice regarding any specific situation. Aflac cannot anticipate all the facts that a particular employer or individual will have to consider in their benefits decision-making process. We strongly encourage readers to discuss their HCR situations with their advisors to determine the actions they need to take or to visit healthcare.gov(which may also be contacted at 1-800-318-2596) for additional information.

Z190012

EXP 1/20