By: Carolyn E. Smith and John R. Hickman, Alston & Bird LLP

On July 17, 2019, the IRS issued new guidance that makes health savings accounts more user-friendly by allowing a high-deductible health plan to cover certain treatments for chronic conditions before the plan’s deductible is satisfied. The IRS has considered issues related to preventive care for HSA purposes for some time. IRS Notice 2019-45, released less than 30 days after the president signed an executive order directing the Treasury and IRS to issue guidance on the issue, provides welcome clarification.

Why HSAs?

HSAs provide a tax-favored means for individuals to save and pay for medical expenses not covered by their insurance plan. To be eligible to contribute to an HSA, the individual must be enrolled in a specially defined type of health plan called an HDHP and have no other health plan coverage (other than certain limited types of permitted coverage such as vision, dental, accident, specified disease and certain fixed indemnity coverage). Individuals enrolled in Medicare are not eligible to contribute to an HSA.

There are three ways that HSAs are tax-favored:

More information about HSAs and HDHPs, including contribution limits and other rules, may be found here.

Why does the definition of preventive care matter?

An HDHP generally cannot pay any benefits before the covered individual meets their deductible, and the individual is responsible for 100% of covered medical expenses before they reach their deductible. The only exception to this rule is for certain preventive care. A broader definition of preventive care makes an HDHP more attractive to employees and provides an incentive for individuals to seek preventive care if it is covered by their plan.

The IRS previously addressed the scope of preventive services under an HDHP in several different rulings and notices. This prior guidance did not include much detail about permitted preventive care for many common chronic conditions.

Expanding the scope of preventive services

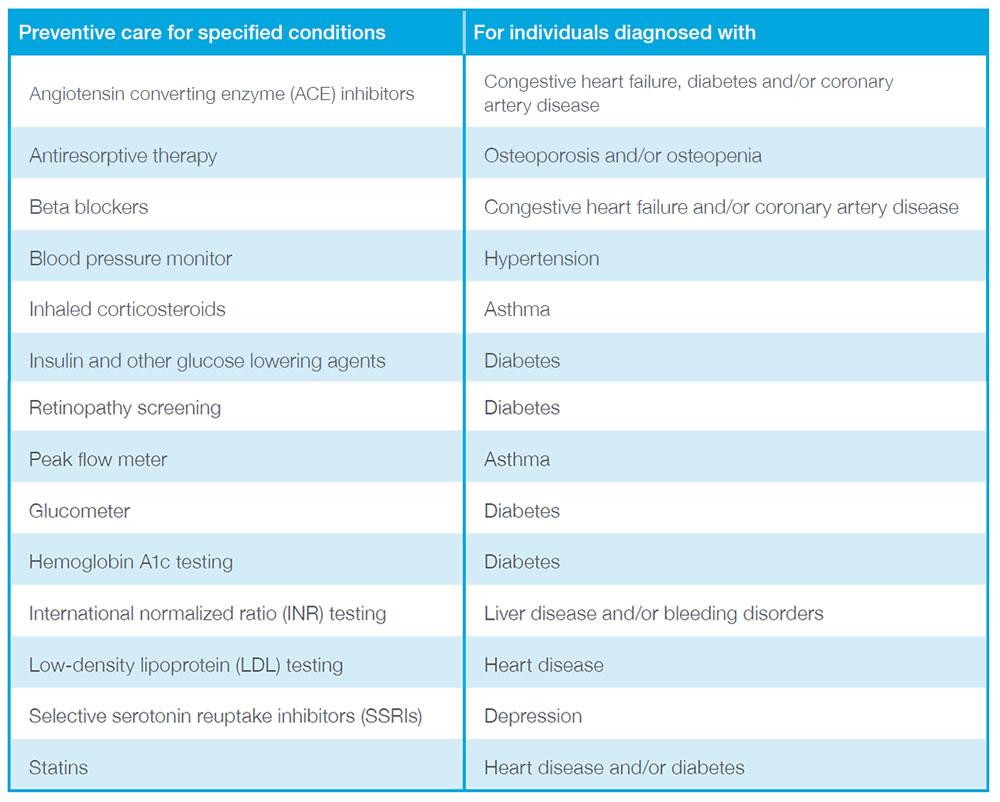

Notice 2019-45 lists 14 specific treatments for certain chronic conditions that are considered “preventive care” for HDHP/HSA purposes.

Considerations for employers

There are a number of issues for employers to keep in mind as they review their HDHP coverage or consider offering an HSA-compliant HDHP:

Conclusion

The new guidance provides some helpful clarification about the scope of preventive services that may be provided under an HDHP for persons with chronic conditions. Employers who offer HDHPs and HSAs (or are considering doing so) should review their plans with the new guidance in mind and consult their advisors about any design changes. As for possible future guidance, the IRS will continue to look at these issues and provide updates (approximately every 5 to 10 years, but hopefully sooner). As there are improvements to medical care and HSAs expand, with more individuals managing chronic illness, the need to appropriately define the scope of permitted preventive care services will remain an on-going issue.

The information above is provided for general informational purposes and is not provided as tax or legal advice for any person or for any specific situation. Employers and employees should consult their own tax or legal advisers. Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York.

Aflac WWHQ | 1932 Wynnton Road | Columbus, GA 31999