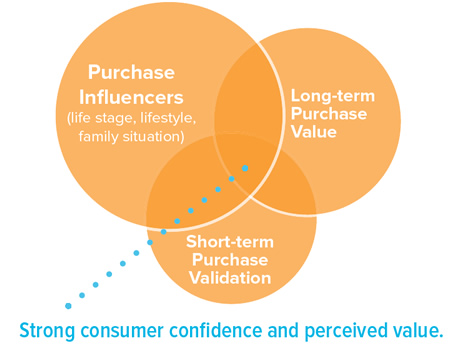

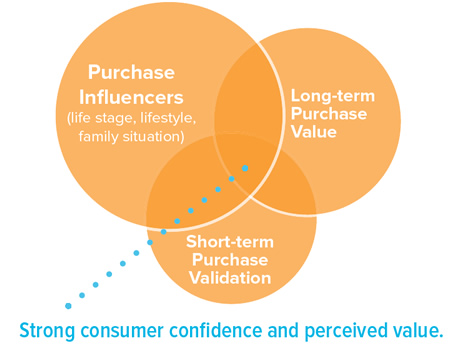

Build buyer confidence and loyalty with strategies that help clients meet short- and long-term demands

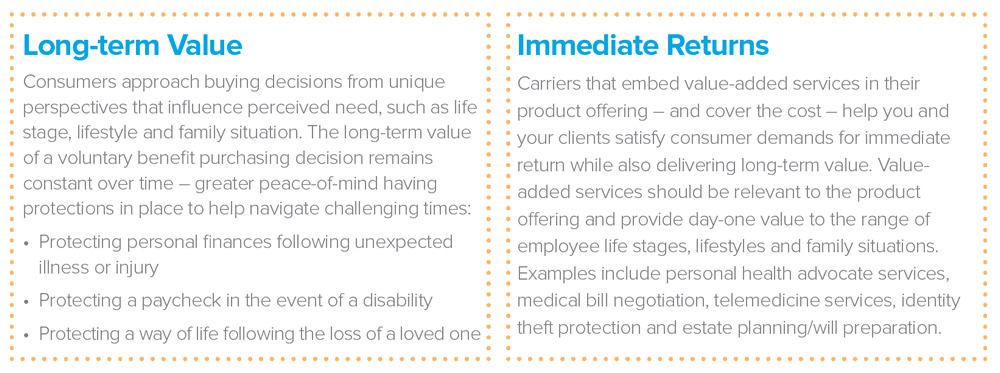

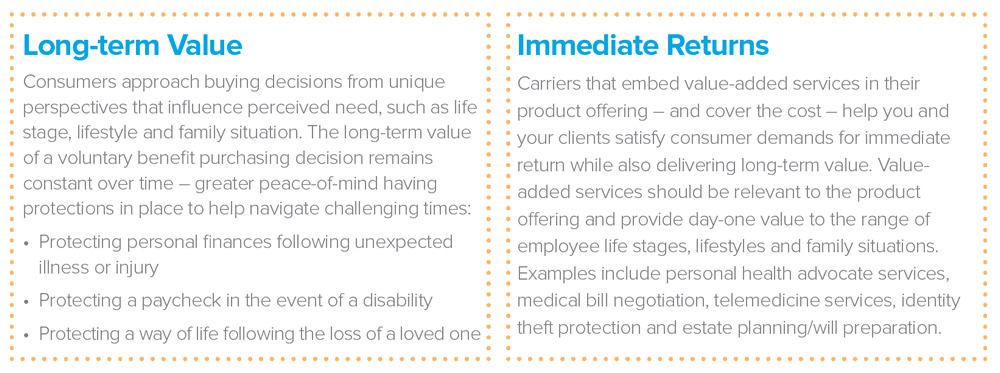

Today’s age of healthcare consumerism demands innovative approaches that build buyer confidence and strong perceived value – the personal, constantly shifting measure of what consumers pay and feel they get in return. While voluntary benefit purchasing decisions are largely based on perceived needs, peace-of-mind for “what if” scenarios is no longer acceptable to consumers who increasingly demand immediate returns on their sacrifice of precious discretionary dollars.

Aligning with a carrier that provides solutions balancing the importance of long-term value and immediate returns can help you and your clients adapt to changing consumer expectations and be more competitive in today’s benefits market.

Aflac offers Health Advocacy, Medical Bill SaverTM and Telemedicine services in all group accident, group hospital indemnity and group critical illness plans. We cover the entire cost, which would run more than $5 per employee per month if purchased directly through service providers. When you offer these Aflac group plans, you’re helping clients add more value to their benefits – without adding to their budget – and helping them meet employee demands for products with immediate returns that help address key healthcare-related challenges from day one: navigating the complex healthcare environment; identifying low-cost options and alternatives; and reducing out-of-pocket expenses.

Seize opportunities to increase buyer confidence in their voluntary benefit purchasing decisions - offer clients and employees solutions that provide long-term value and immediate returns. Talk with your Aflac broker sales professional today about value-added services embedded in our group accident, group critical illness and group hospital indemnity plans.